Premium vs. Par Bonds:

“Price is what you pay. Value is what you get”

– Warren Buffet

Should interest rates remain relatively flat for the foreseeable future, financial institutions will be consistently faced with the decision to invest in premium priced bonds on the secondary market — an investment opportunity that may be met with some resistance from portfolio managers.

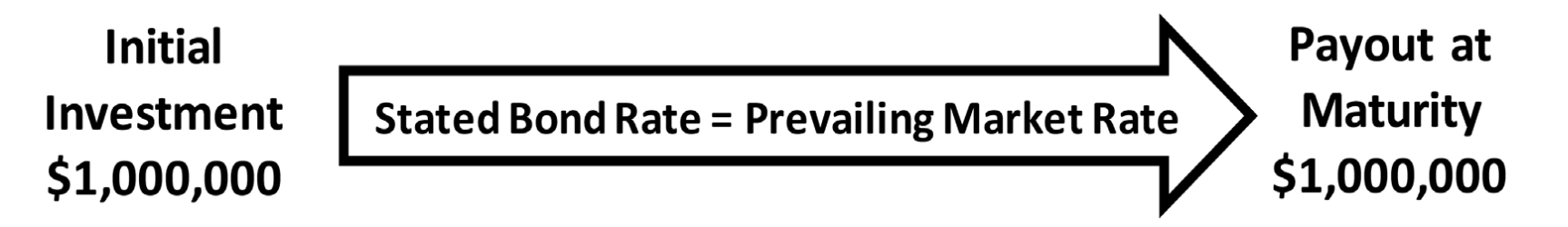

Granted, it’s hard to find a simpler investment than an initial offering of fixed income securities, where bonds are issued at “face value” or “par value.” Thus, the initial investment is equal to the payout at maturity, and the bond’s stated interest rate is equivalent to the prevailing market rate. So, in the end, you get what you pay for, and returns are in line with current market conditions at the time of purchase.

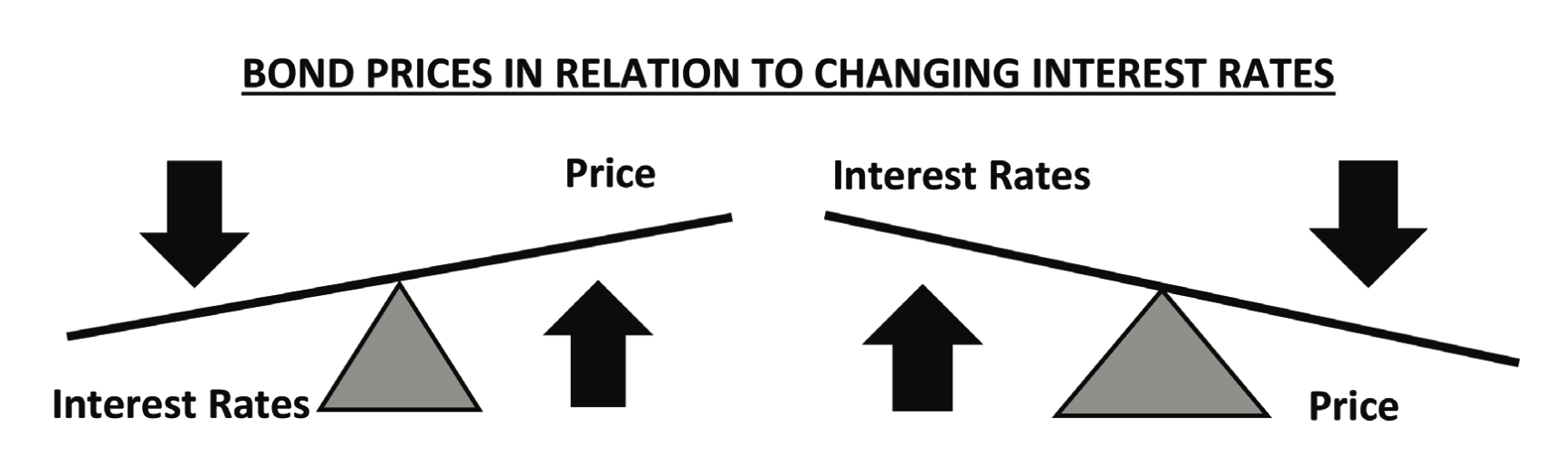

What’s the old adage? “The one thing you can always count on is change” — and that certainly applies to market rates. So, as prevailing market rates decrease or increase relative to a bond’s stated interest rate, the price of the bond must increase or decrease to approximate current yields in order to induce a seller or buyer to act.

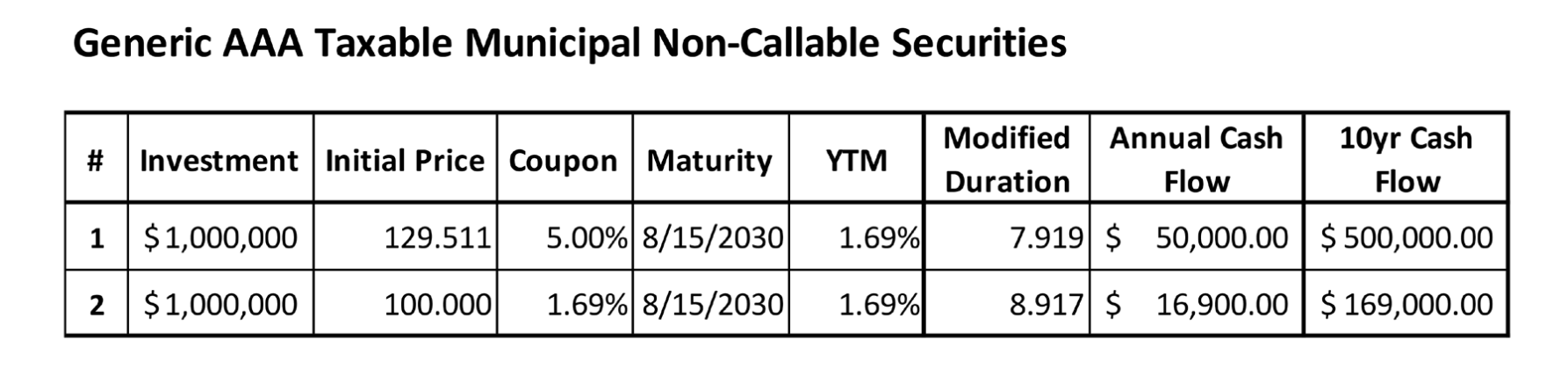

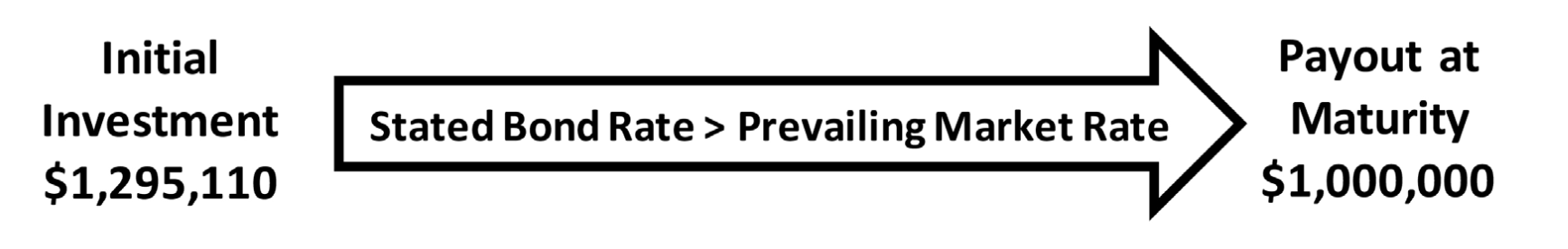

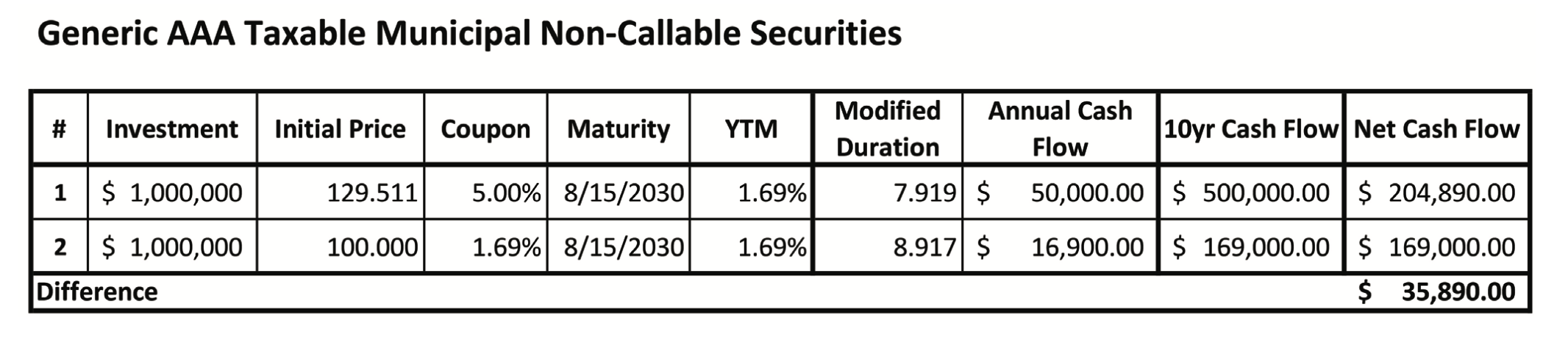

Though, some investors may be hesitant to purchasing bonds at a premium. After all, paying $1,100,000 now to receive $1,000,000 five years from now may not seem like a wise investment, at least at first glance. But with increased emphasis on investment income for financial institutions struggling with anemic spreads, premium priced bonds deserve a second look. Let’s consider the following two investment options:

An investment in option #1 would warrant a substantial premium relative to option #2, sold at par value.

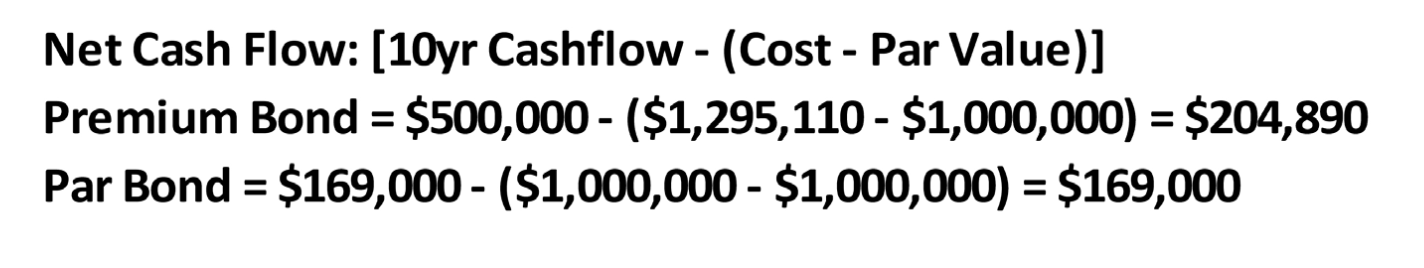

But is there a value in the higher price? Let’s look at the net cash flow for each:

In this example, the premium priced security does offer the greater value as it generates a higher net cash flow of $35,890.

So, what are some other factors to consider when investing in premium priced bonds, beyond the potential increase in net cash flow?

With potentially higher net cash flows, among numerous other benefits, premium priced bonds warrant due consideration when making investment decisions on behalf of your financial institution. At SB Value, we are passionate about investment services and look forward to providing guidance and assistance.

ABOUT THE AUTHOR

John Sacchetti, Senior VP – Capital Markets, Partner

With three boys participating in a variety of sports and activities, my wife and I frequently spend our evenings running in every direction. As a diagnostician for special needs students in the public-school system, I don’t know where she finds the energy, but somehow, she always manages to bring us back together as a family at the end of the day.

At SB Value Partners, L.P.’s, I oversee institutional trading in conjunction with our steady growth nationwide and our commitment to best-in-class services for our Financial Institution partners and their customers. With over twenty years of industry experience, I’ve had the opportunity to managed fixed income departments, achieving record growth, and have worked with major broker dealers managing multi-million-dollar client portfolios. I hold a B.S. in Mathematics from Manhattan College and have served as an adjunct instructor for Alamo Community Colleges.