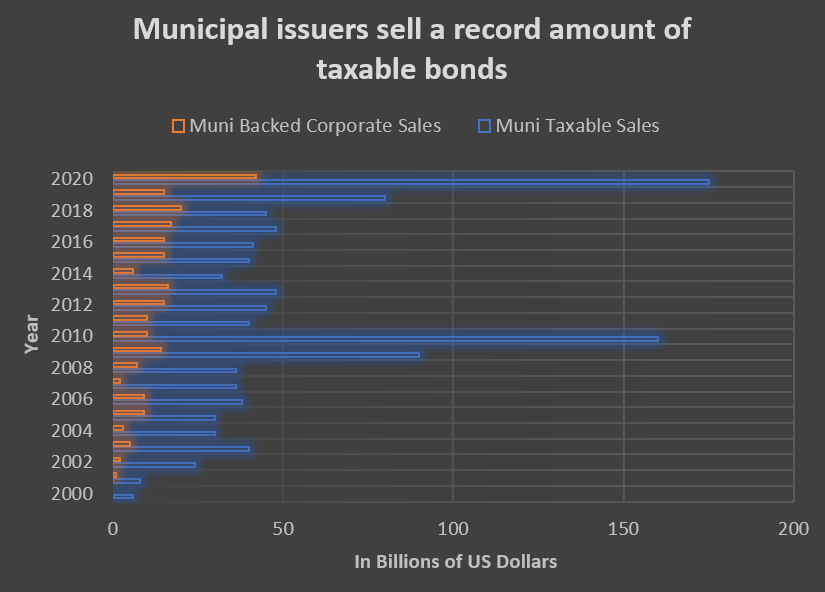

With over $170B of taxable municipal bonds issued in 2020, the year marked a ten year high for new issues, more than doubling the previous year’s issuance of $85B. With this influx of available taxable municipal securities, investors are finding greater options for higher yielding investments relative to comparable fixed income securities, not to mention an increased opportunity for portfolio diversification.

Logically, one would question why there has been such an increase in the issuance of taxable municipal securities. The answer can be simply stated in two words…opportunity and means.

In this low interest rate environment, issuers can take advantage of the opportunity to retire previously issued, higher interest rate, tax exempt bonds and replace them with taxable, lower rate securities, while still achieving interest rate savings. With the Tax Cut and Jobs Act of 2017, issuers now have the means to take such action. And with little advantage for issuers to offer tax exempt securities, they may also be choosing to avoid the IRS accounting rules that accompany the issuance of tax-exempt municipal bonds. The current appeal for issuers to market taxable municipal bonds is apparent in the table below.

ABOUT THE AUTHOR

John Sacchetti, Senior VP – Capital Markets, Partner

With three boys participating in a variety of sports and activities, my wife and I frequently spend our evenings running in every direction. As a diagnostician for special needs students in the public-school system, I don’t know where she finds the energy, but somehow, she always manages to bring us back together as a family at the end of the day.

At SB Value Partners, L.P.’s, I oversee institutional trading in conjunction with our steady growth nationwide and our commitment to best-in-class services for our Financial Institution partners and their customers. With over twenty years of industry experience, I’ve had the opportunity to managed fixed income departments, achieving record growth, and have worked with major broker dealers managing multi-million-dollar client portfolios. I hold a B.S. in Mathematics from Manhattan College and have served as an adjunct instructor for Alamo Community Colleges.