If your financial institution is anything like the programs that I communicate with on a routine basis, your staff has gone above and beyond, during these challenging times, to play a vital role in the ongoing success of your organization.

“Get the right people on the bus and in the right seat.”

James C. Collins

If you already have the right people on your bus, it is more important than ever to adopt a methodical approach in calculating raises for the fast-approaching new year. Moreover, as you build your annual budget, it’s imperative to have a solid understanding of your expenditures for the upcoming year. As salaries are typically one of the largest expenses on the income statement, developing a reliable estimate will help manage expenses as you navigate within the constraints of shrinking margins.

As you approach the new year, I highly recommend that you take into account the following into your wage setting protocol. First, determine the real wage loss that your employees suffered due to the impact of inflation over the past year. The second, referred to as comparables, is to determine if your current wage is competitive within the local labor market. The third and final consideration involves your business’s ability to pay a higher wage in the upcoming year.

Of these three considerations, the one where I can give significant advice is the real wage loss of your employees due to inflation. The other two considerations are dependent on your circumstances and the local economy.

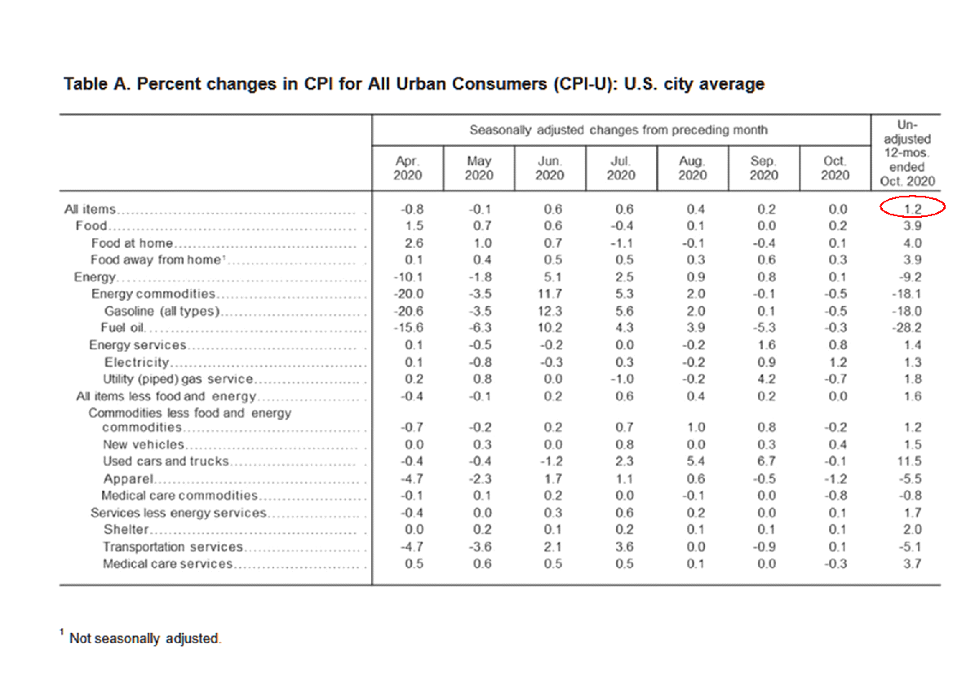

Look to the CPI chart below for help in identifying your employee’s real wage loss due to inflation. The circled data point indicates the general rate of inflation over the last twelve months, for the period ending October 2020. As you can see, your employees lost 1.2% of their purchasing power during the past year. Therefore, a wage increase of 1.2% for 2021 would compensate your staff for their loss.

Data compiled from the Wall Street Journal, Bureau of Economic Analysis, Federal Reserve System, Bureau of Labor Statistics, The Conference Board, Institute of Supply Management, OPEC, US Census Department

Next, consider comparable salaries in your marketplace. To attract and retain the right talent, your financial institution will need to offer competitive salaries and benefits, so be aware of the compensation packages offered by your competitors. Salary research sites are available online, but valuable information can be harvested from employment application, as well. Now is not the time to be distracted by unnecessary turn-over and new employee training.

Finally, consider your ability to pay. Are your profits strong or weak? How much can you afford to pay in annual raises? If you can’t afford to raise salaries across the board, take heart. In leulieu of raises, I have seen firms experience considerable success when implementing monthly and quarterly bonuses based on key performance metrics for both groups and individuals, especially when geared toward accuracy and customer service. Granted, there is a time investment to define the metrics and to review actual results on a routine basis, but the benefits far out way the additional effort. Some of those benefits include enhanced teamwork and a more equitable distribution of income across the staff, which serves to cultivate a positive work environment and foster job satisfaction.

As the new year approaches, be prepared with a reliable salary budget and a compensation strategy to retain your top talent. Remember to consider the latest consumer price index, competitive rates in your marketplace, and your ability to pay. If your budget is stretched too thin for the upcoming year, explore creative ways to compensate and retain your staff.

SB Value Partner’s unique approach to investments has resulted in significant savings and increased liquidity for many of their financial institutional clients. As you prepare your annual budget, keep in mind that SB Value Partners may offer similar cost savings that would allow your financial institution to reallocate funds to your salary budget, other expenditures, or straight to your bottom line.

”

ABOUT THE AUTHOR

Dr. Edmond J. Seifried, PhD

Dr. Seifried is Professor Emeritus of Economics and Business at Lafayette College in Easton, Pennsylvania and Executive Consultant for the Sheshunoff CEO Affiliation Programs.

Dr. Seifried serves as the dean of the Virginia and West Virginia Banking Schools and has served on the faculty of numerous banking schools including: Stonier Graduate School of Banking, and the Graduate School of Banking of the South.