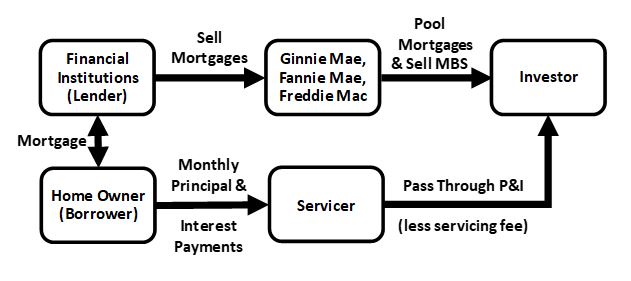

A mortgage-backed security is a type of debt security collateralized by mortgages and primarily offered through Ginnie Mae (guaranteed by U.S. government), Freddie Mac and Fannie Mae (guaranteed by each enterprise). As they are not lending institutions themselves, they acquire mortgages from other financial institutions, pool them, and offer them as investments on the bond market. In exchange, the investor receives monthly principal and interest payments (less a servicing fee). By selling the mortgages, the lending institutions benefits from increased liquidity as they sell a long-term receivable for cash.

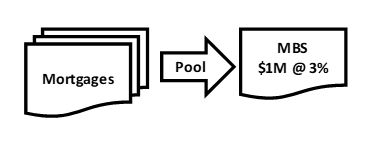

While most investors in MBS may enjoy the benefits of guaranteed principal & interest payments, along with low liquidity risks, they face a unique risk associated with changing interest rates. Unlike most debt securities, where interest payments are fixed regardless of changes in prevailing market rates, interest payments for MBS are a function of the outstanding principal balance of the underlying mortgages. When interest rates drop, even by 75bps, homeowners may refinance their higher-rate mortgages and return the principal balance to the investor. Investors, in turn, would re-invest

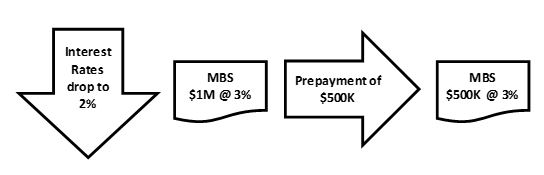

Should the interest rate drop to 2%, homeowners may be incentivized to refinance. For this example, assume that $500K was refinanced and returned to the investor:

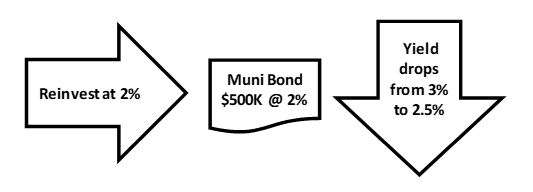

The investor would reinvest the $500K at 2%, the current market rate, resulting in an annual yield of 2.5% and a loss of $5,000.

What Should Investors Do to Mitigate Prepayment Risk:

As with everything in life, there is a give and take. While investors in MBS may enjoy guaranteed principal and interest payment and low liquidity risk, extra due diligence is recommended to mitigate the risk of prepayments of the underlying mortgages. At SB Value Partners, we specialize in asset backed securities and are available to advise when making investment decisions on behalf of your financial institution.

ABOUT THE AUTHOR

John Sacchetti, Senior VP – Capital Markets, Partner

With three boys participating in a variety of sports and activities, my wife and I frequently spend our evenings running in every direction. As a diagnostician for special needs students in the public-school system, I don’t know where she finds the energy, but somehow, she always manages to bring us back together as a family at the end of the day.

At SB Value Partners, L.P.’s, I oversee institutional trading in conjunction with our steady growth nationwide and our commitment to best-in-class services for our Financial Institution partners and their customers. With over twenty years of industry experience, I’ve had the opportunity to managed fixed income departments, achieving record growth, and have worked with major broker dealers managing multi-million-dollar client portfolios. I hold a B.S. in Mathematics from Manhattan College and have served as an adjunct instructor for Alamo Community Colleges.

ABOUT THE AUTHOR

Leslie Heath, Vice President – MBS Specialist

My true passion is sailing. Having spent my childhood living abroad in France, Germany, Libya, and Italy, we finally returned to the states when I was in my early teens. You would think that once we settled back home that I would never again leave solid ground, but I took to the water at 14 years old and have been there ever since. Many weekends are spent enjoying the calm waters, a seasonal breeze, and the setting sun.

With 35 years of extensive experience as a fixed income trader, I’d like to say that I started at age 14, as well, but alas, that is not the case. During those years, I developed a diverse investment background and currently specialize in mortgage related securities: MBS’s, CMO’s, ABS,’s, CMBS’s, ACMBS’s.

Being in the industry for so many years, I’ve had a front row seat for every ebb and flow of the market, and I find that there are many similarities between sailing and market cycles. Sometimes the wind is to your back, the waters are smooth, and it feels like it will never slow down. Other times its choppy, erratic, and unpredictable. As both a fixed income trader and an avid sailor, I find it’s best to be prepared for the unexpected, maintain a standard of excellence, and keep an eye on the horizon.