Summary: Historic Treasury Selloff Opens Old Wounds

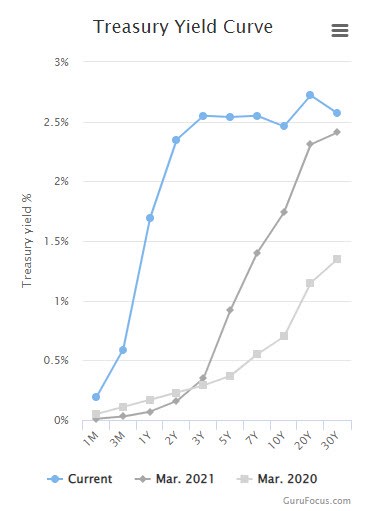

The ongoing sell off in the U.S. Treasury market is increasing the appeal of most fixed income investments, potentially leaving retirement investors with more choice — that is conceptually high yielding stocks or bonds. This is most apparent in the 2-year and 5-year sectors of the bond market, where since January 1st, yields have ballooned 117 bps and 112 bps respectively as of last week.

Yields in the two- and five-year sectors have risen more than their longer-dated counterparts in response to hawkish commentary from Fed officials including Chair Jerome Powell. Swaps contracts tied to Fed meeting dates had priced in 75% odds of a 50 basis-point rate increase at the before the then meeting in May. As recently as the end of February, it was less than 25%. While this move is not necessarily a sign of recession, it could be a warning flag as the 10-year / 3-month spread is much more telling.

Treasury Yield Curves

(March 2022, March 2021, March 2020)

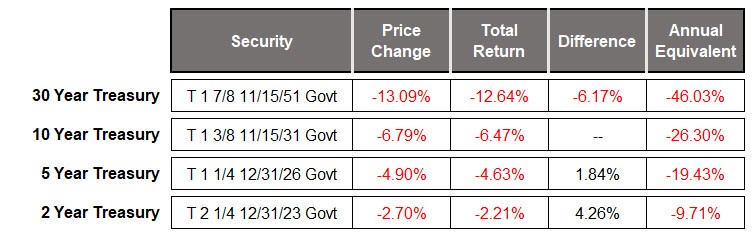

Comparative Returns of Treasury Types, Change In Price & Returns

(12-31-2021 to 3-21-2022)

In any event, how should community financial institutions handle this sell off? Should they buy more floaters? Should they shorten their duration? Which investment solution is best for your institution? Are higher commission based investments taking precedence over lower commission based products that may meet institution current needs more closely?

One thing is important to keep in mind from our perspective and consider putting money to work on a consistent basis. Once funds come due in your portfolio, generally speaking think about taking a dollar cost average approach similar to that of a retail 401k buyer – and, keep in mind that time is often on your side!

As always, consider a first or second opinion from SB Value Partners.

Let SB Value help you examine all these, and other methodologies, to build out your future pathways to optimizing your success.

Questions? ASK US HOW to start a complementary analysis now. It’s a great time to get some additional clarity. Learn some additional truths on the front end. It may position your bank for added improvements in 2022. Listen to what a few thought leaders have to say who have written white papers on the topic at hand. Take a read through a few Fact Sheets on the subject 1. here, 2. here, and 3. here.

As fiduciaries we see quite a lot – in fact we have recently reviewed just under 14,000 data points from Community Financial Institutions – likely just like yours. We look forward to sharing with you some of what we have learned. In the meantime, we thought we would help with some general information that you and your team can consider right away to round out what you are already doing. There is a lot that’s beneficial, starting with cost savings, yield improvements, and likely better balance – even protection. To find out more please click here on our website.