“Chasing Yield” and “The Race to Zero” are two terms being tossed about in the financial press these days — phrases that echo in the ears of every portfolio manager grappling in this zero-interest rate policy environment.

Granted, this is a uniquely difficult time for bond investors. However, there are ways to mitigate the risk of locking in low yields for long duration bonds.

“Those who keep learning will keep rising in life”-Charlie Munger”

Instead of chasing yields on traditional securities…stop, pause, and consider Ginnie Mae HECM Floaters, a class of bonds collateralized with Reverse Mortgages, for appropriate risk levels and investment objectives.

CONSIDER THESE KEY ADVANTAGES:

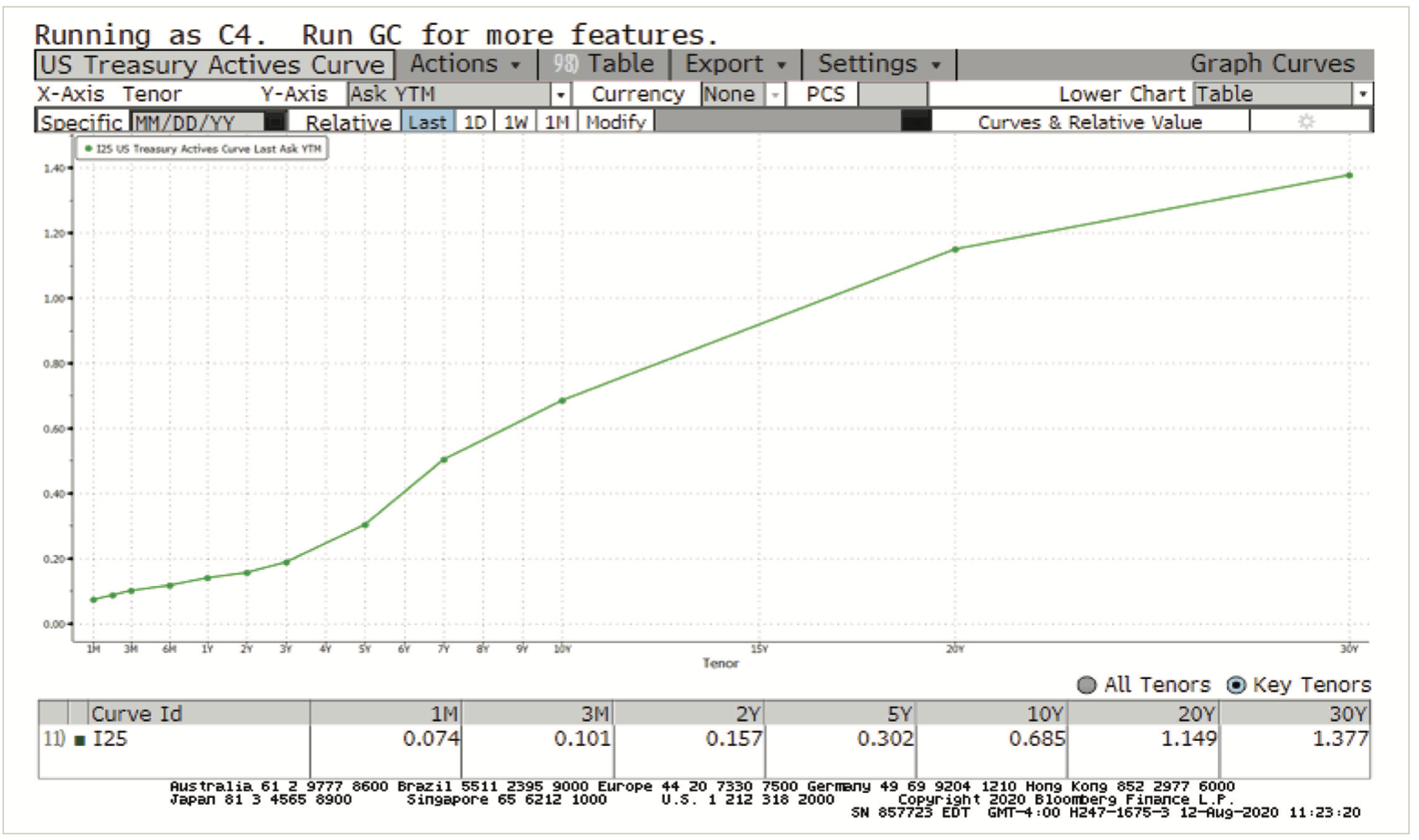

If locking in low fixed-rate yields is a concern, Ginnie Mae HECM Floaters should follow the market when rates turn. Whereas, your institution receives yields only available in the longer end of the curve.

Currently, HECM Floaters yield between .55% to .76%. Compared to the ten-year treasury trading at .68%, Ginnie Mae HECM Floaters provide a very attractive 1-month duration security (note that Bullet Agency paper is trading around .88% for 7.08-year modified duration).

PLEASE SEE THE TREASURY CURVE BELOW:

Source: Bloomberg

Consider HECM Floating Rate MBS as an alternative portfolio investment in this current low yield environment.

For more information about HECM Floating Rate MBS securities, please call us at 210-483-5074 or reply to this email and we at SB Value will be happy to discuss it with you.

ABOUT THE AUTHOR

John Sacchetti, Senior VP – Capital Markets, Partner

With three boys participating in a variety of sports and activities, my wife and I frequently spend our evenings running in every direction. As a diagnostician for special needs students in the public-school system, I don’t know where she finds the energy, but somehow, she always manages to bring us back together as a family at the end of the day.

At SB Value Partners, L.P.’s, I oversee institutional trading in conjunction with our steady growth nationwide and our commitment to best-in-class services for our Financial Institution partners and their customers. With over twenty years of industry experience, I’ve had the opportunity to manage fixed income departments, achieving record growth, and have worked with major broker dealers managing multi-million-dollar client portfolios. I hold a B.S. in Mathematics from Manhattan College and have served as an adjunct instructor for Alamo Community Colleges.