Fixed Income Securities:

An Apples-to-Apples Comparison?

We live in a society that operates in a perpetual state of innovation and advancement, and as such, we are continuously bombarded with the message that newer is always better. But is that always the case?

“An investment in knowledge pays the best interest.”

Benjamin Franklin

Consider new issues of municipal bonds. Most would assume that a new issue would be perfectly priced based on current market conditions, interest rates, credit ratings, maturities, call dates, etc. Most investors also assume that new issues have no cost associated with their purchase, as they are priced “net to the customer”.

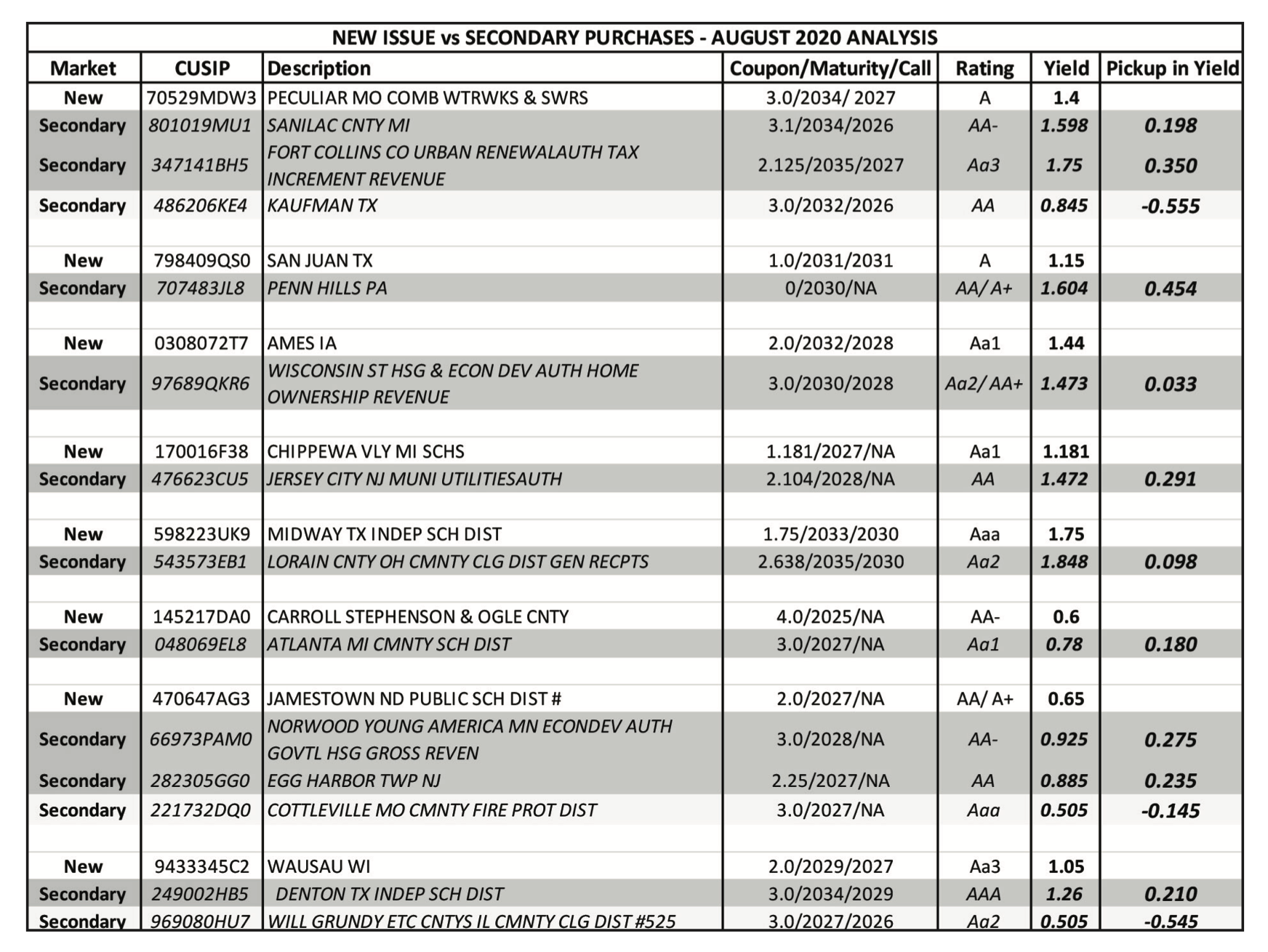

It’s not uncommon to find higher yields on secondary market purchases of fixed income securities— in fact, a diligent search for appropriate secondary market municipal offerings OFTEN turns up higher yielding securities with similar sizes, ratings, and risk profiles. The following illustration compares new issue securities with secondary offerings available during the same period: GRAFICO

Why Do “Commissionless” New Issue Bonds Often Yield Less Than Similar Secondary Securities?

The answer is simple: new issue municipal bonds usually (if not always) contain underwriting fees, referred to as underwriter discounts in documents or as takedowns on offering sheets. (Obviously, underwriters are paid for the services they render, and any costs associated with the marketing of securities will reduce the yields/returns of those securities.)

There are two types of underwriting structures: a negotiated sale and a competitive issue. Each structure can influence the underwriting fees, the proceeds awarded to the issuer, and the risk to the underwriter. Other contributing factors include the size of the issuance, ratings, maturity schedule, and current market conditions.

SB Value constantly surveys the market to find the best available pricing and yields across both primary market and secondary market securities for our clients to increase portfolio performance. Comparing new issue yields, credit ratings, sizes, and maturity schedules with previously issued secondary market securities will often produce a greater total return opportunity… and a more knowledgeable bond buyer.

A CALL TO ACTION! Community Financial Institutions are in uncharted waters, with margin compression, unprecedented liquidity, and a dearth of investment opportunities. As the industries low-cost advisor of fixed income portfolios, let SB Value Partners, LP show you how to generate additional ROA and ROE from your investment portfolio.

ABOUT THE AUTHOR

Larry Anderson, VP Fixed Income

For over ten years, I have dedicated my free time to competing in pointing breed field trials with Weimaraners. During the spring and fall we participate in competitive field events that evaluate their level of independence, range, and hunting ability. My wife and I also enjoy spending leisure time with our four dogs at my family’s ranch in West Texas.

During market hours, I collaborate with our experienced traders on the fixed income trading desk in support of our Institutional Advisory program. I have over 20 years of experience with fixed income products, including Municipal Bonds, MBS, CMO, Corporate Bonds, and Structured Products. Prior to joining SB Value Partners, I worked for several major broker/dealers in the industry and received a B.S in Agricultural Systems Management from Texas A&M University.