“To enjoy a reasonable chance for continued better-than-average results, the investor must follow policies which are inherently sound and promising…”

– Benjamin Graham, Security Analysis: Principles & Technique

No doubt, the decision-making policies that impact the health and financial growth of your organization are sound and rigorous. You provide best-in-class client services, adhere to strict regulatory guidelines, hire top candidates, and more. It’s not easy, but it is the right course of action.

What about your investment policies? Are they as sound and promising? Would you believe that investing in one single security may NOT be as sound – or profitable – as breaking that investment up into smaller, higher yielding bonds with the same profile?! (Making a large investment in a single security may be easier...but it’s often not optimal.)

Purchasing the largest par value security possible for a specific portfolio need is a widely adopted practice… and it is certainly a simple thing to do. However, why would you invest $2MM in a single security when you could invest $500K in four equivalent quality securities that might generate a higher yield? Large securities purchases are so commonplace that you may not have even stopped to consider the soundness of the policy, but in this zero-interest rate environment, now is the time to question everything…

SO…WHAT IS SUBSTITUTION & AGGREGATION?

Simply stated, Substitution & Aggregation casts a wider net in search of similar quality investments to potentially achieve a higher yield/total return with greater diversification.

CAN SUBSTITUTION & AGGREGATION REALLY IMPROVE YIELDS?

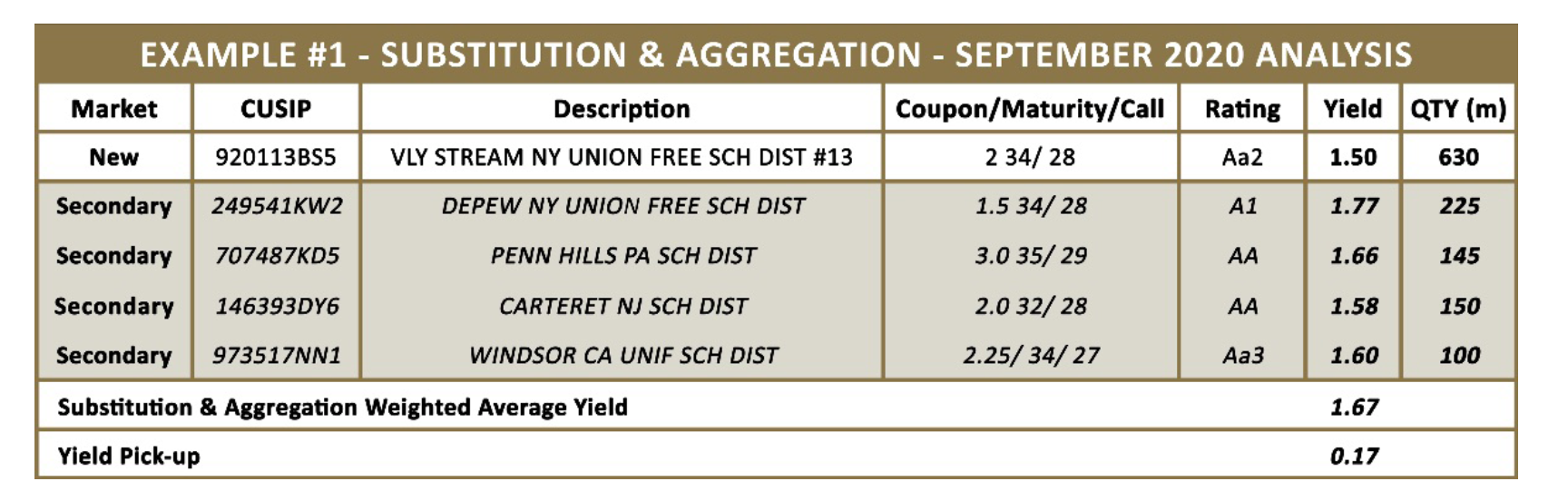

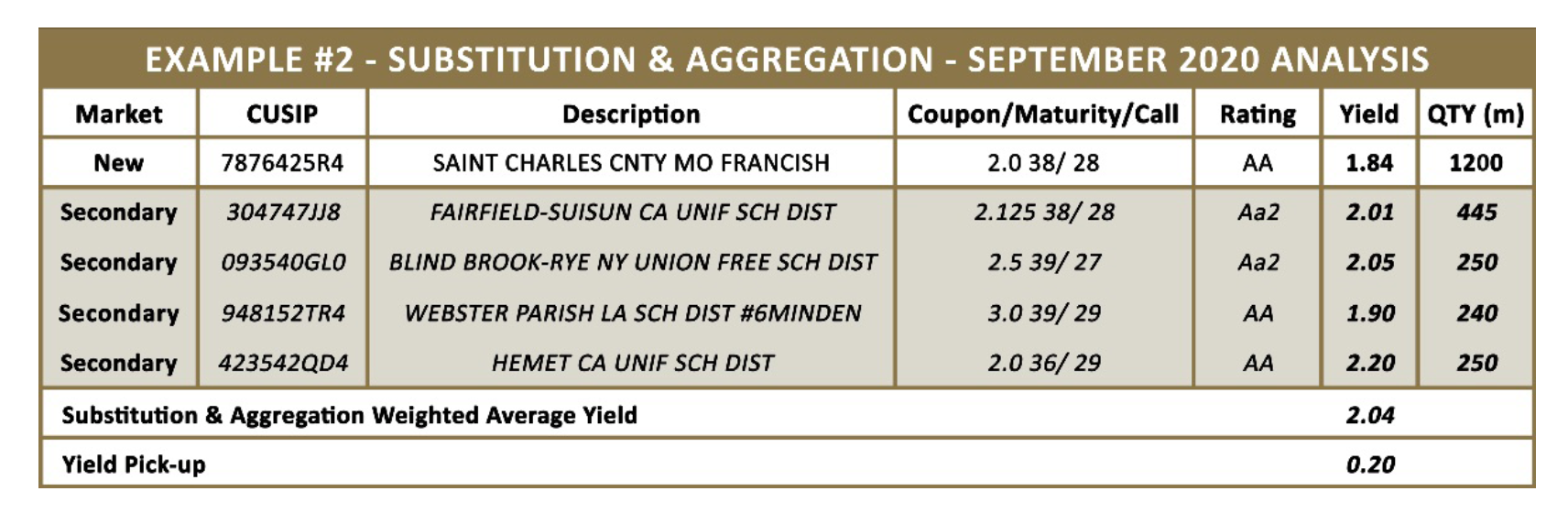

Let’s take a quick glance at securities available during September 2020:

In example #1 above, an investment of $630,000 would yield 1.5% if the entire amount were invested in the specific single new issue security. Utilizing a substitution and aggregation methodology, the purchase of four securities, with similar risk structure and maturities, would yield a weighted average yield of 1.67% — resulting in a yield pick-up of .17%.

With $1,200,000 to invest, example #2 provides for an even greater yield pick-up. The specific new issue security in the example would yield the purchaser 1.84%, compared to four purchases of securities with a weighted average yield of 2.04% — resulting in a yield pick-up of .20%.

Substitution and aggregation does have the potential to increase yields – and your investment portfolio’s ROI.

ADDED DIVERSIFICATION THROUGH AGGREGATION

As seen in the examples above, substitution and aggregation provide a more diverse underlying group of geographic areas to spread portfolio risk – specifically, 4 states vs 1 in the larger position. In MBS transactions, substitution and aggregation can spread portfolio risk amongst a wide variety of mortgage sizes, locations and risk profiles.

SUMMARY

Is a potential added 20 bps per transaction and increased diversification worth the effort? This is for you to decide; however, in our current zero interest-rate environment with massive yield and loan margin compression, we contend that this approach to your securities portfolio – and your bank operations in general – is imperative to stay competitive in this rapidly evolving industry.

At SB Value, we leverage both traditional and artificial intelligence tools to provide our partners with more choices and investment opportunities…with potentially increased yields on investments through our utilization of substitution and aggregation methodologies.

ABOUT THE AUTHOR

John Sacchetti, Senior VP – Capital Markets, Partner

With three boys participating in a variety of sports and activities, my wife and I frequently spend our evenings running in every direction. As a diagnostician for special needs students in the public-school system, I don’t know where she finds the energy, but somehow, she always manages to bring us back together as a family at the end of the day.

At SB Value Partners, L.P.’s, I oversee institutional trading in conjunction with our steady growth nationwide and our commitment to best-in-class services for our Financial Institution partners and their customers. With over twenty years of industry experience, I’ve had the opportunity to manage fixed income departments, achieving record growth, and have worked with major broker dealers managing multi-million- dollar client portfolios. I hold a B.S. in Mathematics from Manhattan College and have served as an adjunct instructor for Alamo Community Colleges.