Summary: Many institutions forget, or have overseen, one key word. That is the word “and” in the guidance language. With the current market turmoil, unrealized losses, and warning lights of a future slowdown, it is precisely the “and” that regulators and examiners may choose to double down on during an institution’s exams. The OCC guidance and Dodd-Frank are crystal clear on what should happen in an institution’s “ongoing portfolio due diligence processes.” Two points come to mind where banks may (and likely do) have gaps in these areas, and then working to better meet the oversight “key factors” required, while not relying solely on ratings agencies in the oversight. There are easy solutions if you know where to look, and now is likely the time to look more deeply.

It’s about the “and“.

On November 29, 2011, the Office of the Comptroller of the Currency (OCC) proposed guidance to assist national banks and federal savings associations in meeting due diligence requirements for assessing the credit risk of portfolio investments. The OCC then issued final guidance that clarifies regulatory expectations with respect to investment purchase decisions and ongoing portfolio due diligence processes. As mentioned earlier, the watch-out often overlooked by financial institutions is after the “and.”

It’s about much more than just ratings agencies.

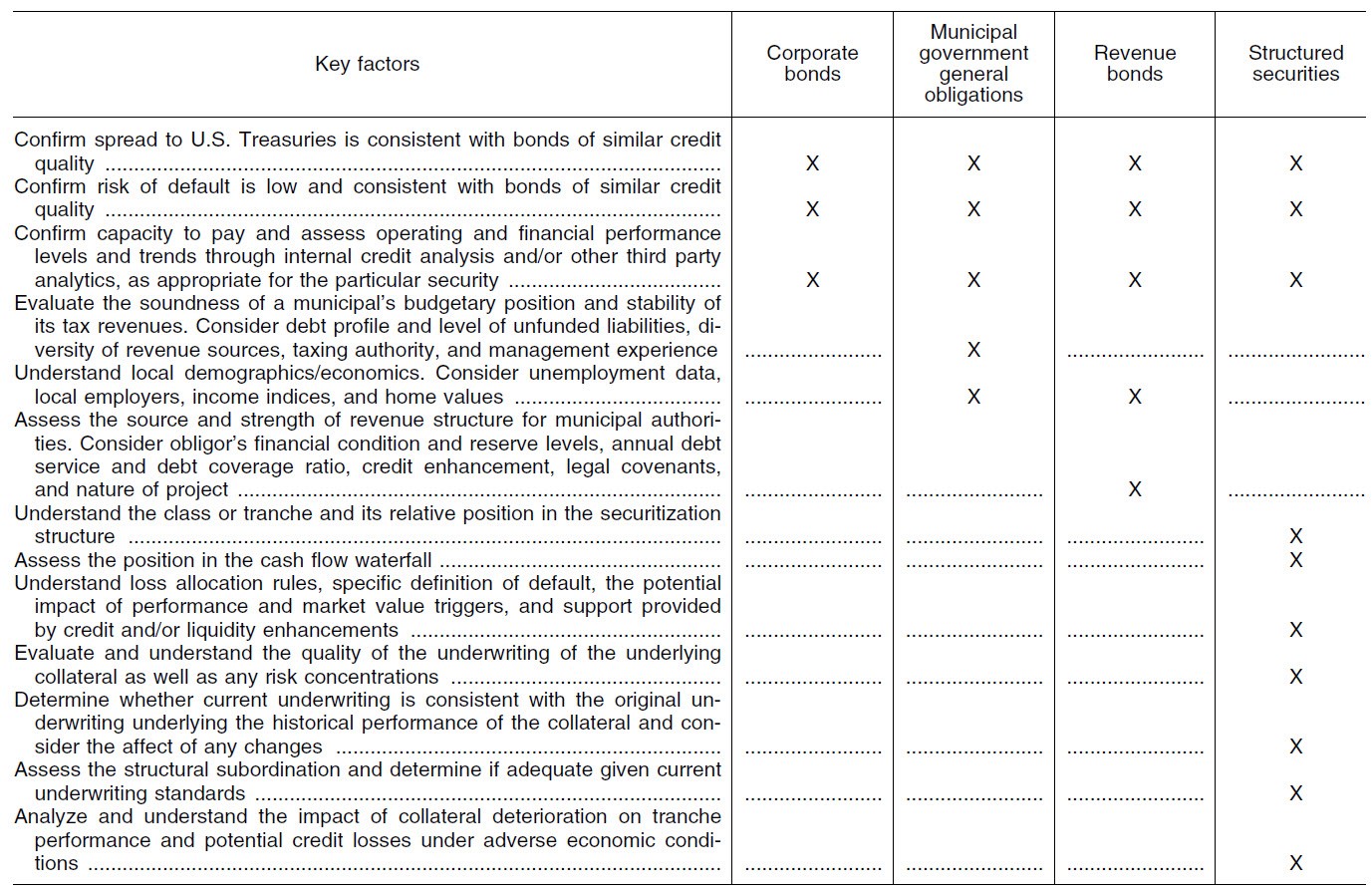

Dodd-Frank and the OCC guidance are quite specific and outline criteria that require digging much deeper than most cursory analytics. Take another look to make sure that what you are looking at meets the below criteria, and not just a few of them since all criteria should be met and should pass reviews at regular intervals. In fast moving markets like today’s, a monthly review is likely better than quarterly, and definitely better than a yearly review. Finding sources that simplify and aggregate the complexities of the table below into an easy to navigate report is important. A report needs to highlight potential problems to look at and to better meet the bank’s liquidity, performance, regulatory oversight, capital, leadership team, BOD, shareholder needs. Many reports just don’t fit the need. Find the summary reports that meet Dodd Frank and OCC guidance – don’t assume. Confirm from multiple independent voices.

Key factors in ongoing due diligence Risk Assessment due diligence include the following:

The specifics. It’s likely worth a re-read.

Please find attached the OCC Guidance 12 CFR Parts 1 and 160. It speaks to both the purchase of and continued oversight of securities. It’s the “and” we want to focus on in this reading.

Before your next exam and/or BOD meeting consider getting a complementary in-depth independent review.

A second set of eyes, with respect to Dodd-Frank and OCC guidance, and review of your portfolio is likely a good idea. One that looks at the above factors outlined in greater aspects of the regulatory guidance should greater scrutiny come. Have it in your back pocket for your next exam and regulatory review. As an advisory firm, we offer community financial institutions a complementary Transparency Analysis that includes a risk assessment review. Now is a great time to take advantage of it. Please get with your financial advisor at SB Value to guide you through these turbulent times of balance sheet change and oversight challenges in a volatile market. If you don’t get one from an advisory firm like ours, do get one from another reputable firm who is a fiduciary to you.

As always, consider a first, second, or even third opinion from SB Value Partners by eMailing or calling us back today. Let SB Value help you examine all these, and other methodologies, to build out your future pathways to optimizing your success.

Questions? ASK US HOW to start a complementary analysis now. It’s a great time to get some additional clarity. Learn some additional truths on the front end. It may position your bank for added improvements into 2023 and into a better positioning for 2024. Listen to what a few thought leaders have to say who have written white papers on the topics at hand. Take a read through a few Fact Sheets and SME articles on the subject that we would be happy to provide.

As fiduciaries we see quite a lot – in fact we have recently reviewed just under 17,000 data points from Community Financial Institutions – likely just like yours. We look forward to sharing with you some of what we have learned over the last three decades. In the meantime, we thought we would help with some general information that you and your team can consider right away to round out what you are already doing. There is a lot that’s beneficial, starting with cost savings, yield improvements, potential risk reduction, and likely better balance – even protection. To find out more please click here or go to our website.