Summary: While the M1 money supply does seem daunting and inflation does seem to be an imminent challenge, long term globalization through technology should keep it at bay. Once we learn to coexist with Covid, the basic tenets should resurface in our lives – they are Globalization and Democratization. Increasing trade integration and greater participation of low-cost producers in global production has a direct disinflationary effect. In addition, advancements in technology should lead to further democratization as people absorb more information and typically want more for themselves and their families. We believe that these tenants are not going away and that once the opposing M1 and M2 tug-of-war reverts back to recent decade long norms, that recent decade-long trajectories should regain their footings.

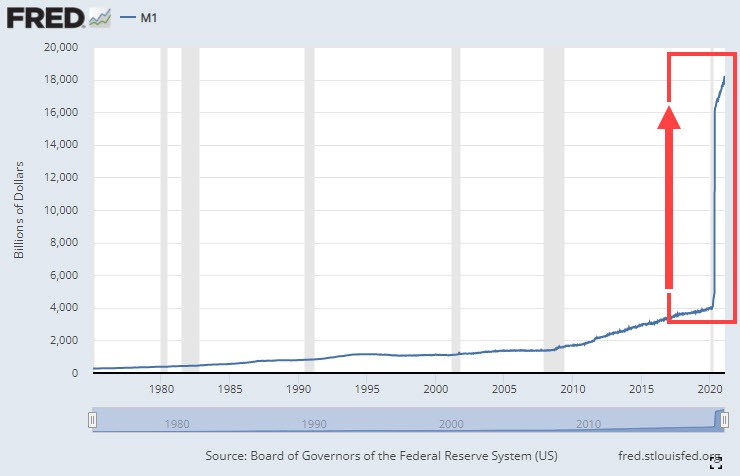

The below chart from Fred depicts the Money Supply created by the both the Fed and the Executive Branch of Government through Quantitative easing and Fiscal policy M1. In a simplified form,

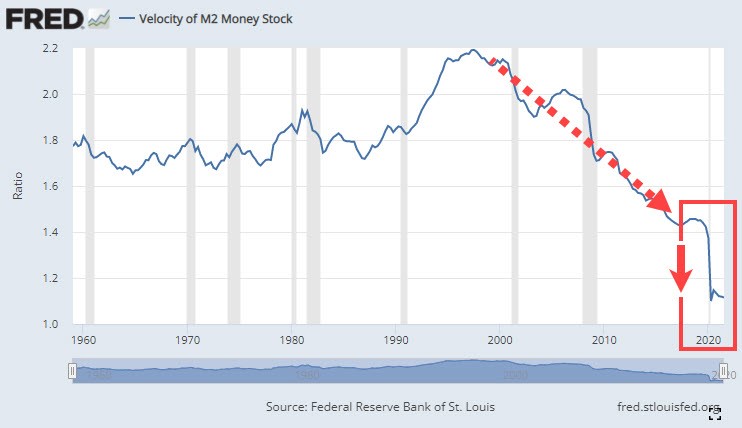

Below is a depiction of how the economy came to a halt during the pandemic and how money was not exchanging hands at previously declining velocities. Velocity of Money Chart – M2 as presented by Fred.

Velocity of Circulation refers to the average number of times a single unit of money changes hands in an economy during a given period of time. It can also be referred to as the velocity of money or velocity of circulation of money. It is the frequency with which the total money supply in the economy turns over in a given period of time.

If the velocity of money is increasing, then the velocity of circulation is an indicator that transactions between individuals are occurring more frequently. A higher velocity is a sign that the same amount of money is being used for a number of transactions. A high velocity indicates a high degree of inflation.

Happy New Year. We are looking forward to 2022.

Questions, so, ASK US HOW. Start a complementary analysis now. It’s a great time to get some additional clarity. Learn some additional truths on the front end. It may position your bank for added improvements in 2022. Listen to what a few thought leaders have to say who have written white papers on the topic at hand. Take a read through a few Fact Sheets on the subject 1. here, 2. here, and 3. here.

As fiduciaries we see quite a lot – in fact we have recently reviewed just under 13,000 data points from Community Financial Institutions – likely just like yours. We look forward to sharing with you some of what we have learned. In the meantime, we thought we would help with some general information that you and your team can consider right away to round out what you are already doing. There is a lot that’s beneficial, starting with cost savings, yield improvements, and likely better balance – even protection. To find out more please click here on our website.