DATE: May 5, 2021 | BY: Dr. Edmond J. Seifried, PhD | TOPIC: The Big Question…So What’s Next?

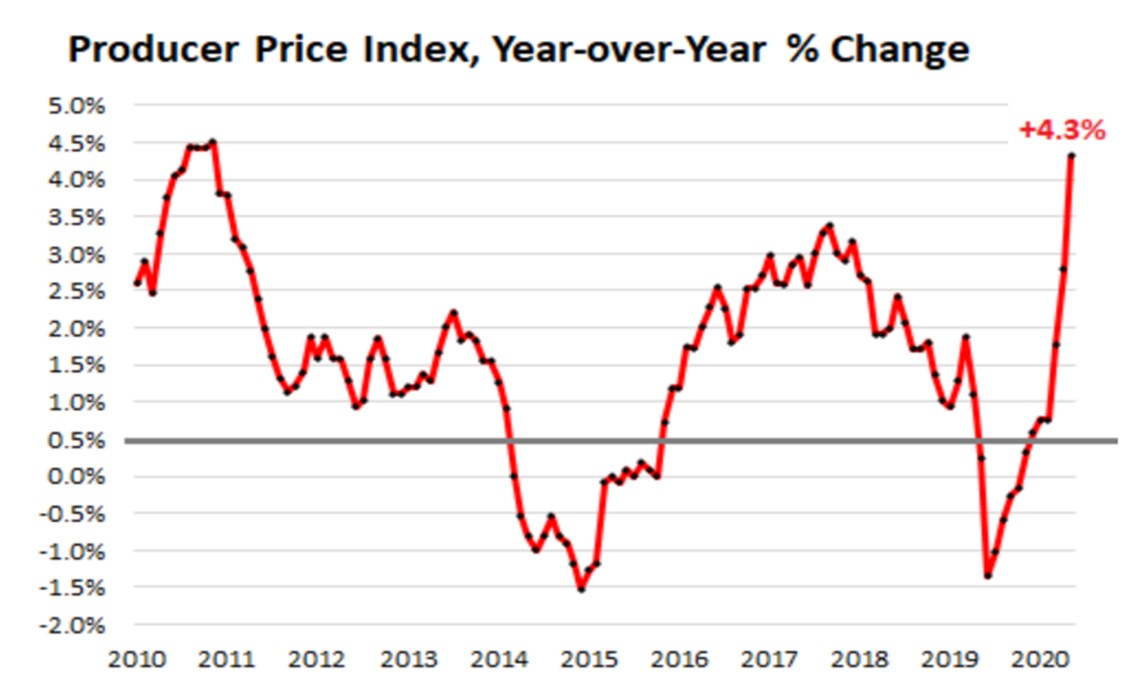

As indicated in the chart below, the BLS Producer Price Index release reflected an increase of 4.3%, marking the beginning of an inflationary period.

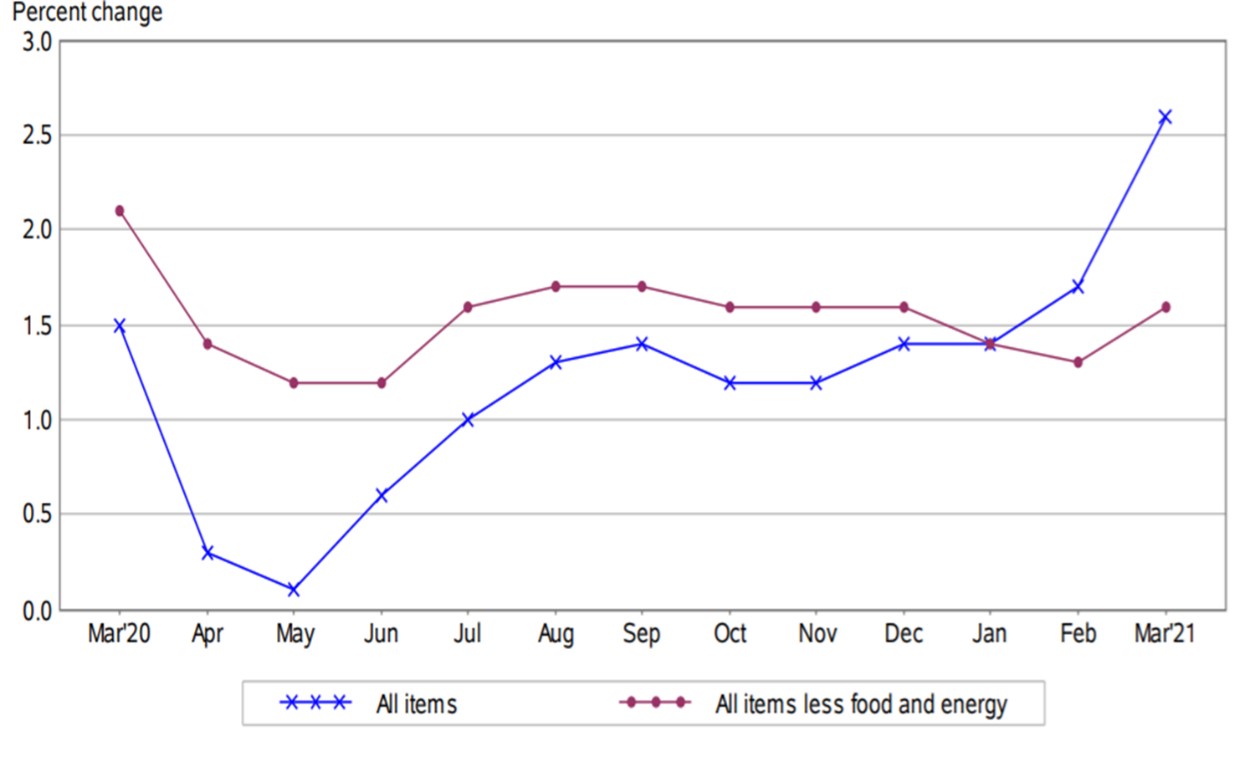

The Consumer Price Index was the big news for the first quarter of 2021. The total CPI jumped to 2.6% and the core CPI (all items less food and energy) rose to 1.6%.

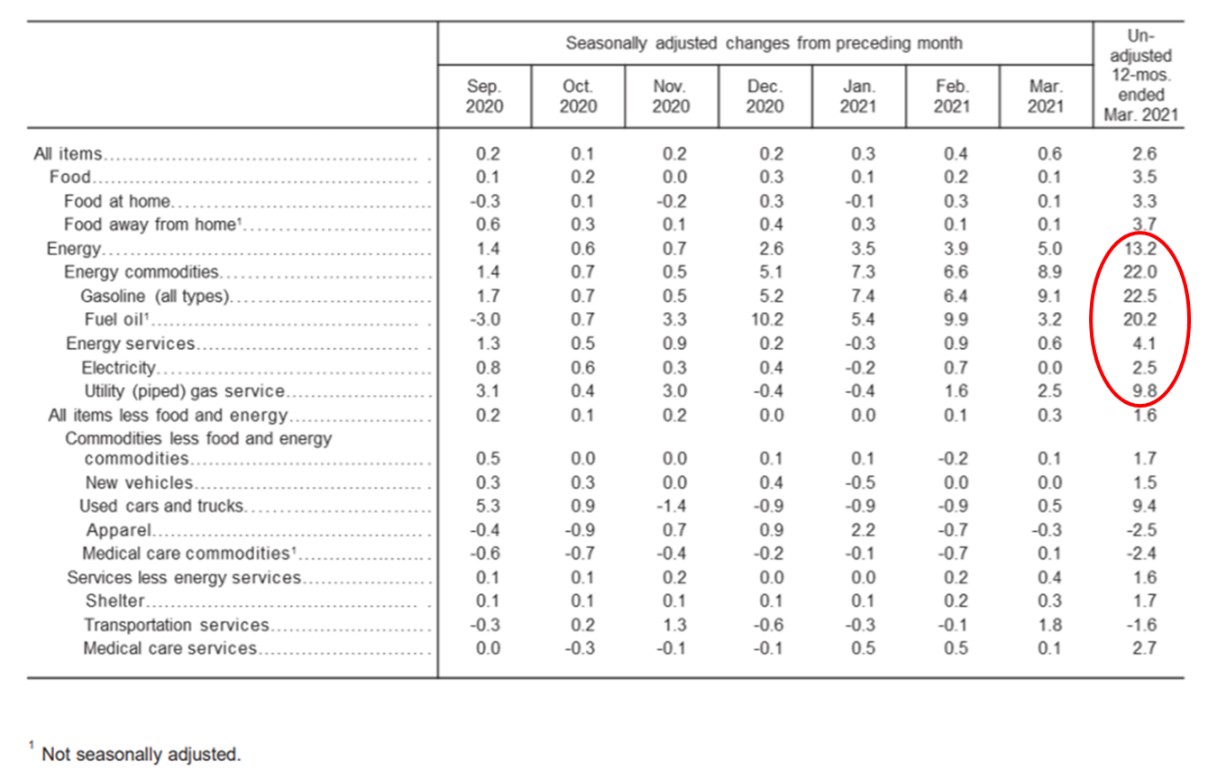

Per the chart below, the energy sector experienced significantly higher increases in inflation. Deflation occurred in the sectors of apparel, medical care, and transportation services.

The big question…how long will this inflationary period last? There is good reason to believe that inflationary rates will level out in the short-term. Keep in mind that over the next few months, the 12-month measures of inflation will move up as the very low readings from March and April of 2020 drop from the calculations. We could also see upward pressure on prices if spending rebounds quickly as the economy continues to reopen. However, these would likely be one-time increases and only have a transient effect on inflation.What effect did the government stimulus have on inflation? Chairman Powell, in a March 23, 2021 address to Congress, stated, “Our best view is that the effect on inflation will be neither particularly large nor persistent.”It is interesting to note how the average household made use of their stimulus checks. If your financial institution has experienced a decrease in overdraft protection fees, the survey below might explain why.

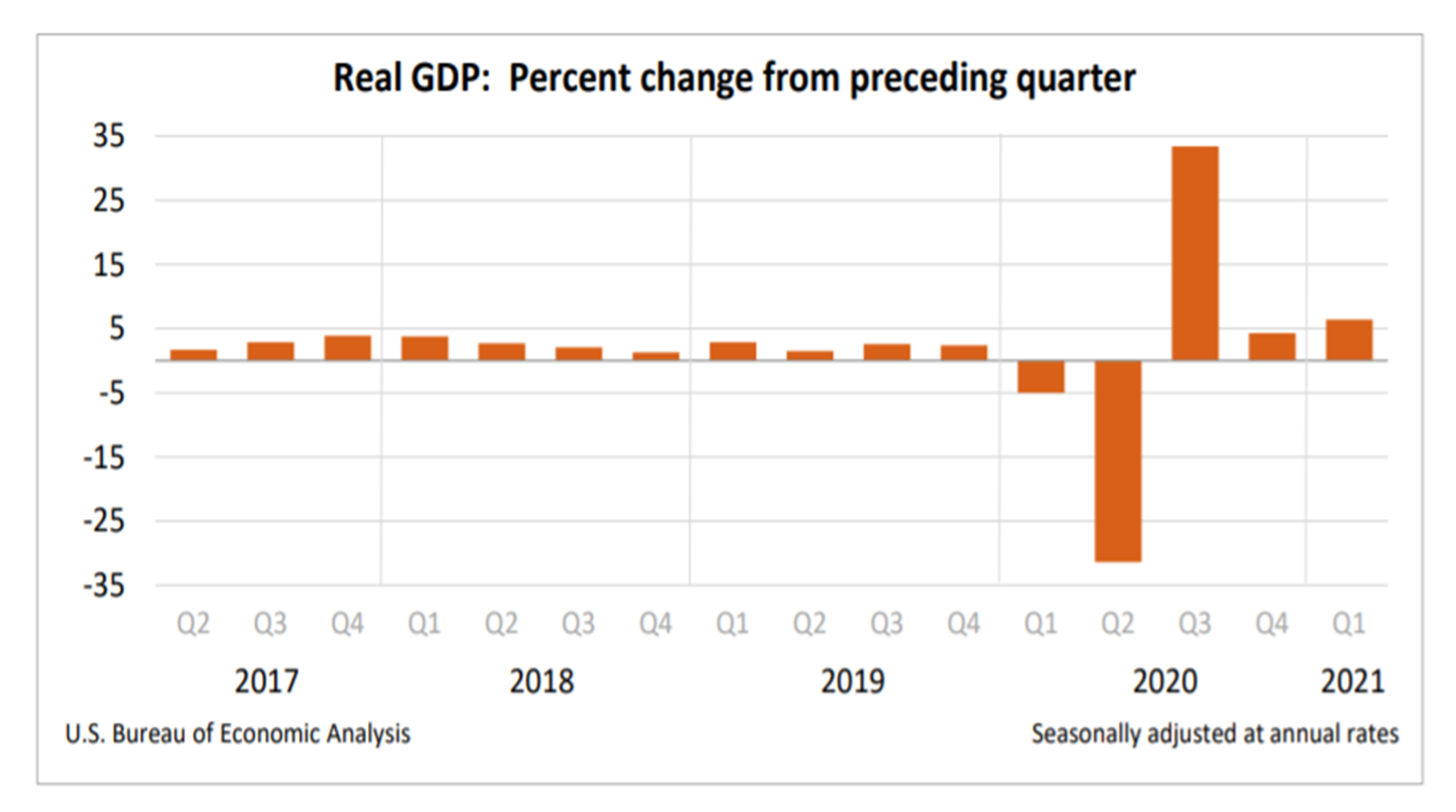

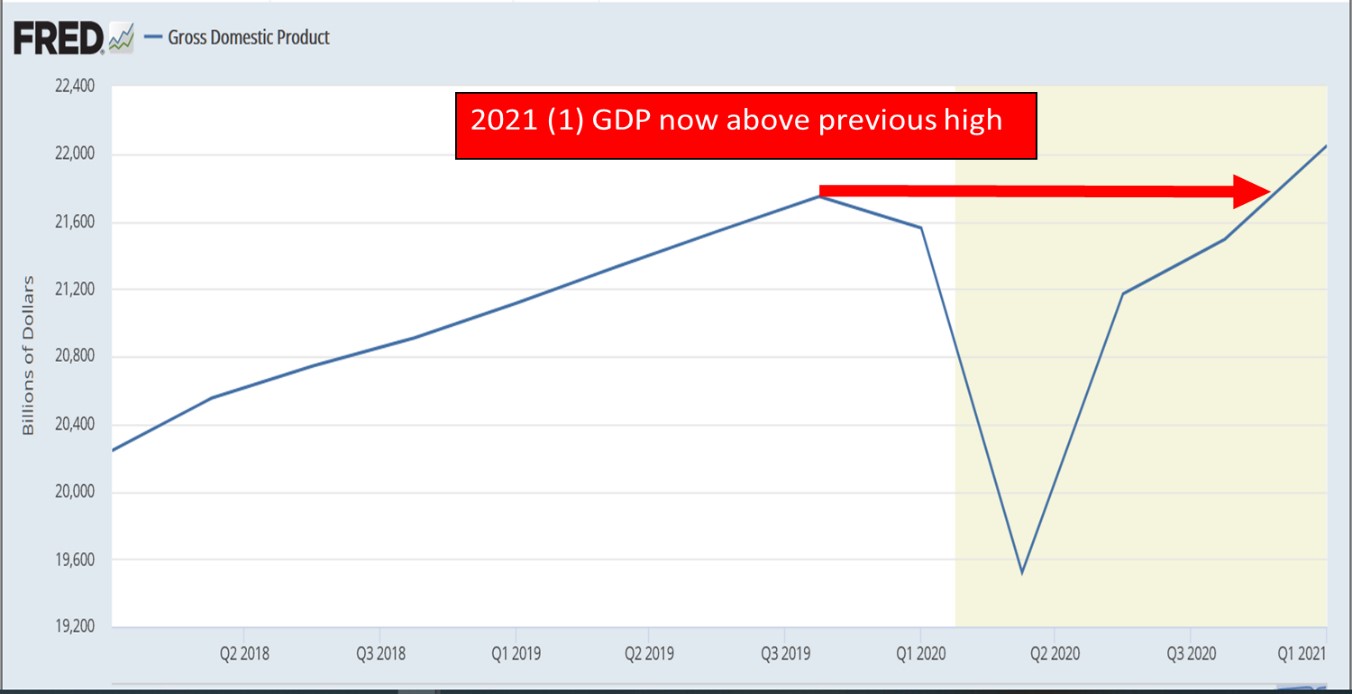

The GDP for Q1 2021 surpassed pre-COVID 19 levels, marking the probable end of the recession. As shown in the chart below, it appears that the U.S. economy is experiencing a V-shape recovery. The general consensus of the Federal Reserve is that 2021 will continue to experience growth for the remainder of the year.

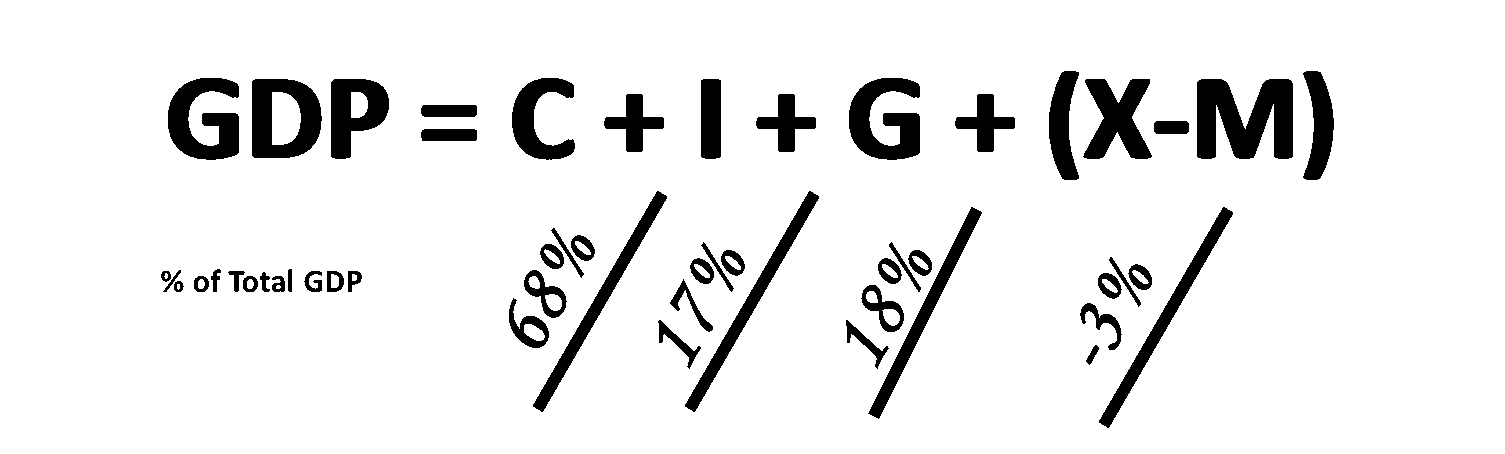

The equation below represents the current percentage breakdown of GDP by consumer, investment, and government spending, offset by net exports and imports.

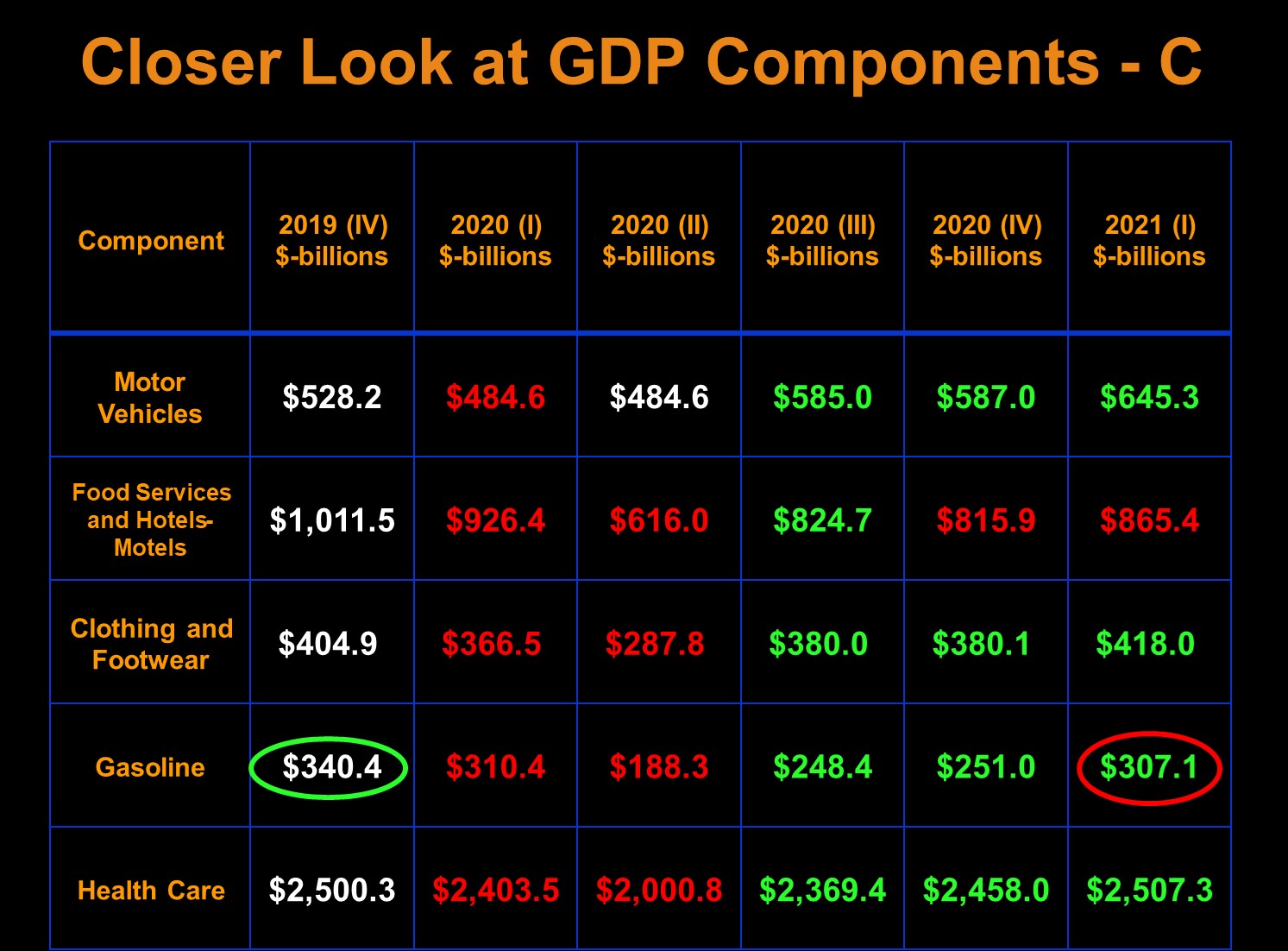

Consumer spending is the significant driver of GDP growth, comprising 68% of the total. Vehicle sales and clothing & footwear experienced strong growth, while food services & hotels are still struggling through the pandemic. Gasoline spending has been increasing over the past three quarters. However, it continues to fall short of pre-COVID 19 levels, likely due to ongoing telecommuting and higher unemployment rates.

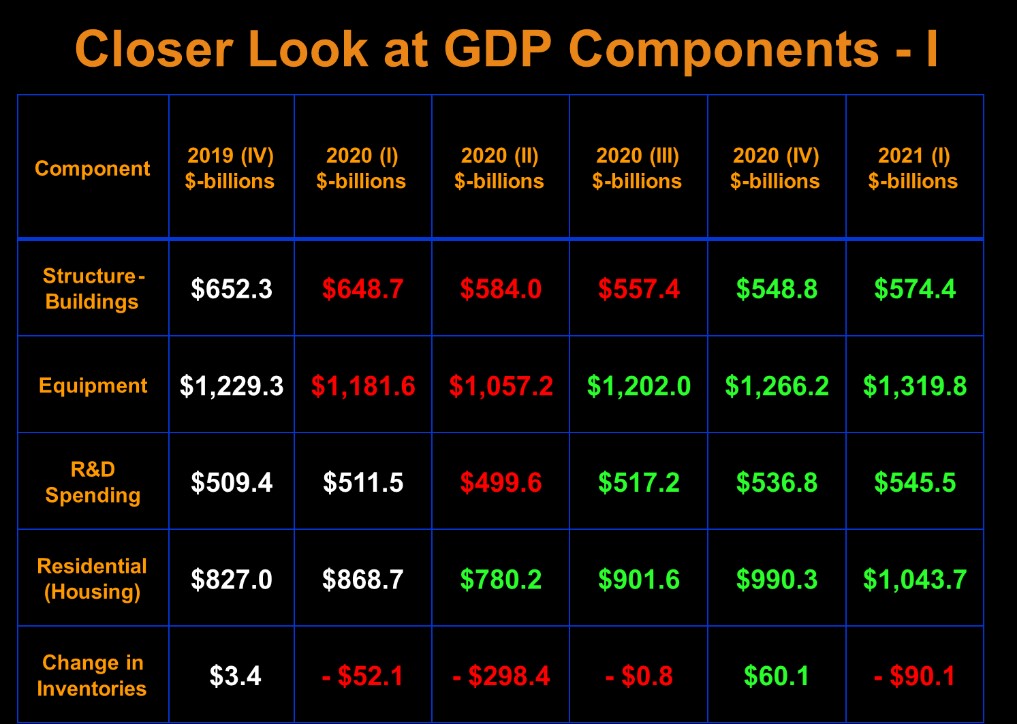

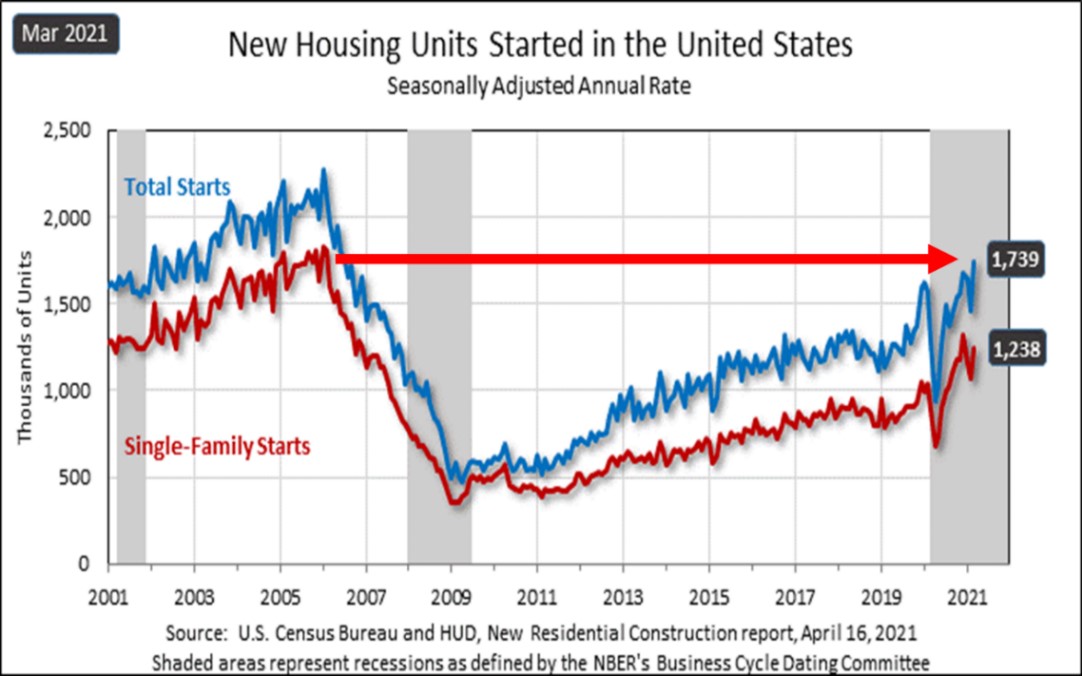

As the primary driver for the increase in investment spending, the residential housing sector may be one of the bright spots for 2021. Equipment and R&D spending continue to increase. Inventories are dropping dramatically, possibly due to disruptions in supply chains.

As displayed in the chart below, housing starts for March 2021 approached levels that we have not seen since 2007. According to the U.S. Census Bureau, HUD, New Residential Construction report, dated April 2021, the volume of building permits was 1,766,000 compared to housing starts of 1,739,000. Based on current statistics, this housing trend may continue in a positive direction. Financial Institutions should be prepared to see a potential increase in loan demand.

As discussed in previous quarterly reviews, R-Star is known as the equilibrium rate of interest. It is the rate of interest that is neither stimulating nor restraining to the economy. It represents the Fed Fund interest rate that would exist if:

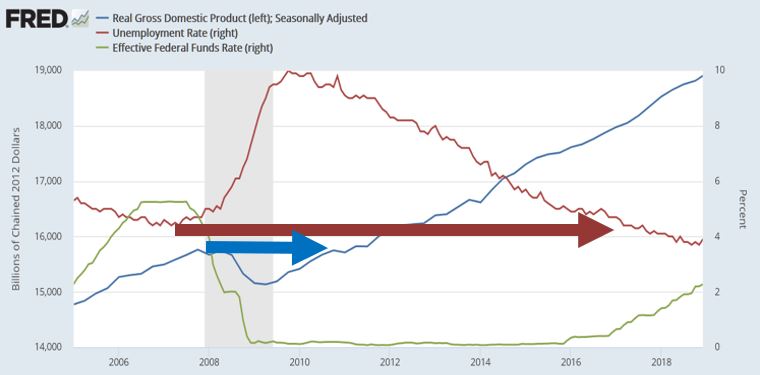

With a rising inflation rate (possibly temporary) and GDP surpassing pre-recession levels, the Federal Reserve is staying the course. Consider the comments by Chairman Powell in his February 21, 2021 address to Congress:“The Fed is looking to see actual progress, not forecasted progress, toward its employment and inflation goals before we tighten our policies.”In summary, the U.S. economy needs to experience two recoveries before the Federal Reserve may consider a change in interest rates. GDP appears to have recovered, but now unemployment rates will be the key factor to watch, especially if history is any indication.Consider the Federal Reserve’s response to the great recession, as illustrated in the graph below. The green line indicates the drastic drop in interest rates. Although GDP recovered and continued to rise, interest rates did not increase until unemployment rates normalized.

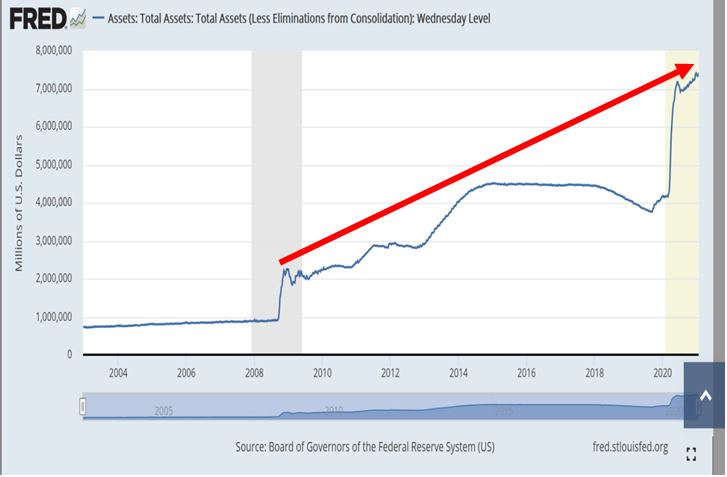

The Federal Reserve is continuing its practice of quantitative easing, purchasing fixed income securities at a rate of $120B per month. Although we have discussed this at length in previous quarterly reviews, one recent comment made by Chairman Powell in his February 21, 2021 address to Congress is worth noting:“We will maintain ultralow interest rates and continue hefty asset purchases until substantial further progress has been made.”Based on his comments, we should expect to see a decline or cessation of bond purchasing before they consider increasing interest rates. Meanwhile, they will continue to grow their balance sheet, as illustrated in the chart below.

Executive leadership of high-performance financial institutions must accept and adapt to an environment of shrinking margins, at least for the foreseeable future. Gone are the days of operating in the status quo. “Because we’ve always done it that way,” must be stricken from the vocabulary of management and staff positions, alike.

My advice for high-performance financial institutions…

”

ABOUT THE AUTHOR

Dr. Edmond J. Seifried, PhD

Dr. Seifried is Professor Emeritus of Economics and Business at Lafayette College in Easton, Pennsylvania and Executive Consultant for the Sheshunoff CEO Affiliation Programs.

Dr. Seifried serves as the dean of the Virginia and West Virginia Banking Schools and has served on the faculty of numerous banking schools including: Stonier Graduate School of Banking, and the Graduate School of Banking of the South.