BREAKING NEWS — MARKET SPECULATION & THE STATE OF THE ECONOMY

DATE: November 7, 2022 | BY: Dr. Edmond J. Seifried, PhD | TOPIC: The Big Question…Is a recession on the horizon?

- The November 2022 Unemployment Rate and the Labor Force Participation Rate was 3.7% and 62.2%, respectively. Sahm’s Rule holds that a recession occurs whenever the three-month moving average of the unemployment rate rises 0.5% over its minimum rate from the previous 12 months. Currently, we are at 0.2%. Watch for changes as we move into 2023.

- By unanimous consent, the Fed Funds Rate was increased by .75%, bringing the new range to 3.75-4.00%. In September 2022, Chairman Powell outlined possible future rate hikes, projecting 4.4% by year-end 2022, a median estimate of 4.6% for 2023, and a decline to 2.9% in 2025.

- GDP rose by 2.6% in Q3, due to a rise in exports largely caused by a stronger dollar, coupled with a decline in exports which is unlikely to continue. Despite Q3 growth, the report offered evidence of a sluggish economy with consumer spending slowing and residential investment declining by 26.4%. The Atlanta Fed’s GDPNow is projecting an increase of 3.6% for Q4. Watch GDPNow for updates throughout the quarter.

- Higher mortgage rates and rising housing prices are negatively impacting housing starts. With average housing starts trending at 1.7 million homes per year, recent starts have fallen to 1.4 million, the worst drop in twelve years. However, building permits are continuing to exceed housing starts

IS A RECESSION ON THE HORIZON? CONSIDER THREE POWERFUL ECONOMIC INDICATORS…

- The Composite Leading Index has predicted every recession since WWII with 100% accuracy. Comprised of 10 economic indicators, such as building permits and orders for consumer goods, the index indicates a 70% chance of a recession if it drops for three consecutive months by 1% or more. During 2022, the index has been declining for seven straight months with a drop of 2.8%, beginning with the April index of 118.7 through the September index of 115.9.

- The PMI (Purchasing Manager’s Index) fluctuates above or below 50% as the manufacturing economy expands or declines, respectively. A PMI below 43.2% indicates an overall economic decline and a possible recession. With an October PMI of 50.2%, the index hasn’t fallen below a concerning level, yet the number has been consistently falling month over month.

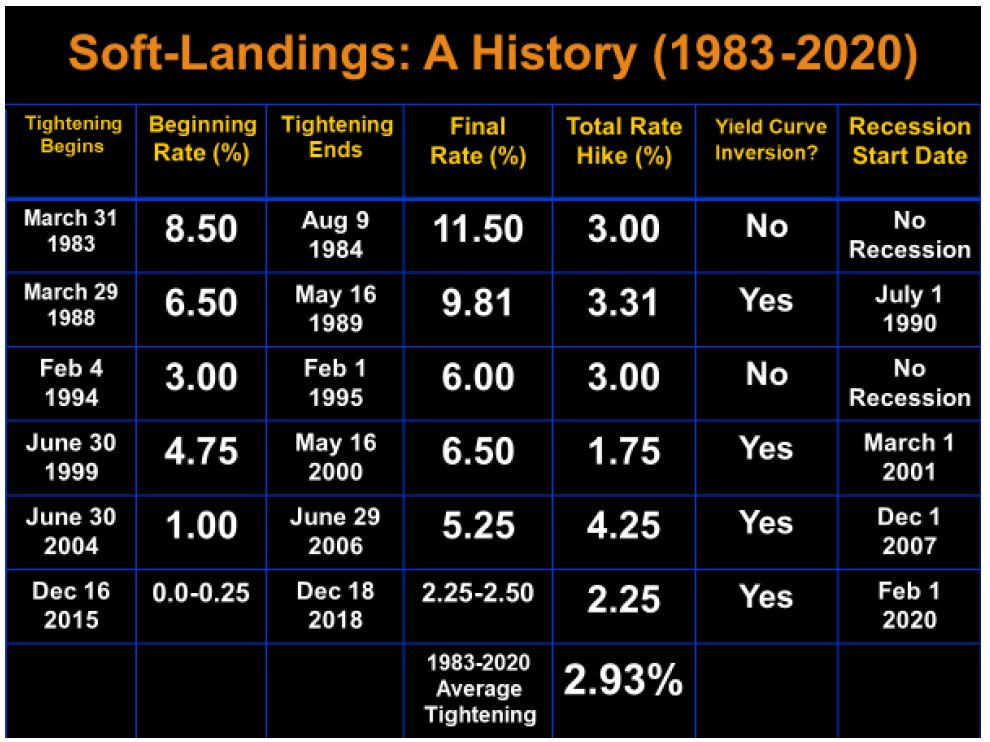

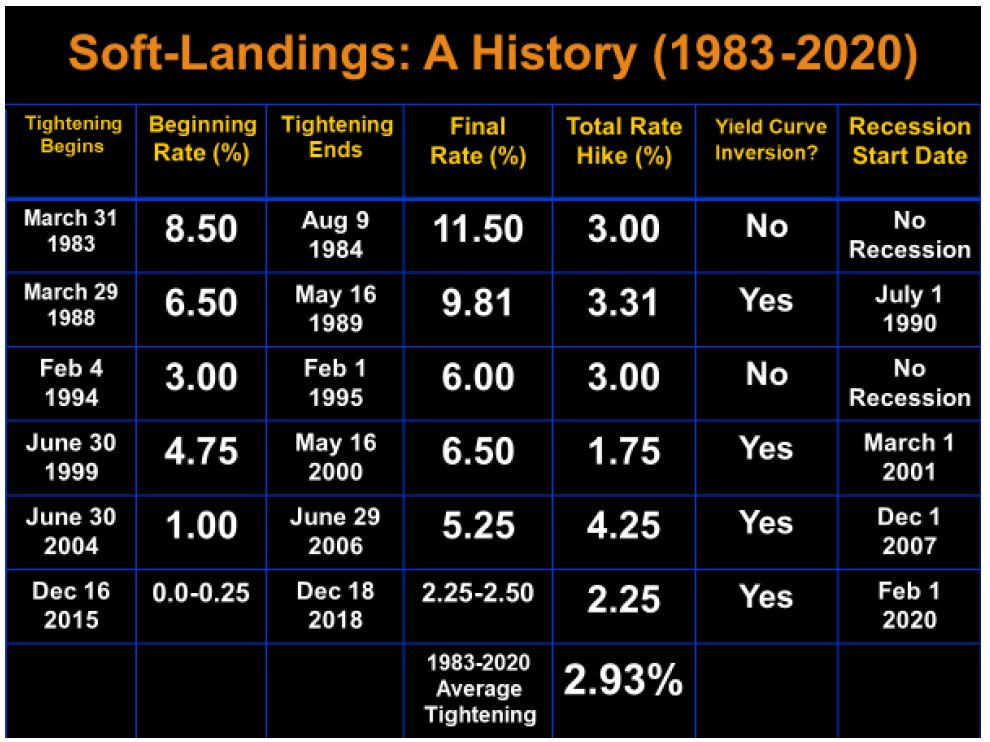

- The US Treasury Spread, the difference between the 10-year rate and the 90-day T-bill rate, indicates a possible recession when the yield curve becomes inverted (the Treasury spread is negative). To date, the yield curve is inverted but only slightly, indicating a 25% possibility of a recession. The table below correlates quantitative tightening, the resulting rise in interest rates, and an inverted yield curve with the inception of a recessionary period. From 1983 through 2020, an inverted yield curve preceded recessionary periods; conversely, when the Treasury spread remained positive, the US avoided a recession, and the Federal Reserve achieved a soft landing.

DR. ED’S FINAL THOUGHTS

Regulators are likely to vigorously question your securities management practices…

- 1Expect scrutiny regarding security losses and their impact on Capital and AOCI (Accumulated Other Comprehensive Income).

- 2Be prepared to defend your Investment Policy Statement.

- 3Be prepared to demonstrate the ability to protect capital for safety and soundness purposes in today’s volatile market.

- 4Contact SB Value Experts for Additional Strategies and AI tools.

”

ABOUT THE AUTHOR

Dr. Edmond J. Seifried, PhD

Dr. Seifried is Professor Emeritus of Economics and Business at Lafayette College in Easton, Pennsylvania and Executive Consultant for the Sheshunoff CEO Affiliation Programs.

Dr. Seifried serves as the dean of the Virginia and West Virginia Banking Schools and has served on the faculty of numerous banking schools including: Stonier Graduate School of Banking, and the Graduate School of Banking of the South.

Serving community financial institutions for 30 years.

Providing portfolio advisory services to approximately $2.3 Billion of community bank and credit union investment portfolios.

Actively managing over $477 Million for community financial institutions and their customers in managed accounts and 3(C)(1) L.P.’s.

SEC NUMBER 801-66139.

John EvansSVP – Growth & Development

William BarnesVP – Business Development

![]()

![]()

![]()

![]()