BREAKING NEWS — MARKET SPECULATION & THE STATE OF THE ECONOMY

DATE: May 3, 2022 | BY: Dr. Edmond J. Seifried, PhD | TOPIC: The Big Question…Can the Federal Reserve lower inflation rates without triggering a recession?

- Major results from the May FOMC meeting:

- By unanimous consent, the Federal Reserve voted to raise rates by ½% which is the largest increase in over 20 years.

- The Federal Reserve will begin to reduce their balance sheet beginning in June 2022, with a per month reduction of $47.5 billion for June, July, and August and a $95 billion per month reduction thereafter.

- By tightening monetary policy through increasing interest rates and by reducing its holdings in treasury securities, agency debt, and mortgage-backed securities, the Federal Reserve hopes to lower the current PCE index inflation rate of 6.4% to 4.3% by year-end.

- With six remaining FOMC meetings in 2022, there are six more opportunities to raise rates. Some committee members are targeting a rate of 2.5% by year-end.

- GDP fell to -1.4% in Q1, primarily due to increased spending on imports and a sharp decline in inventory investments. GDPNow forecasts a modest +1.6% for Q2.

- Personal savings decreased to $1.21 trillion in Q1 compared to $1.3 trillion in Q4. The personal saving rate (personal saving as a percentage of disposable personal income) dropped to +6.6% in Q1, relative to +7.4% in Q4.

CAN THE FEDERAL RESERVE LOWER INFLATION RATES WITHOUT TRIGGERING A RECESSION?

In his March 2022 speech in Washington DC, Chairman Powell stated, “In our FOMC projections, the economy achieves a soft landing, with inflation coming down and unemployment holding steady.”

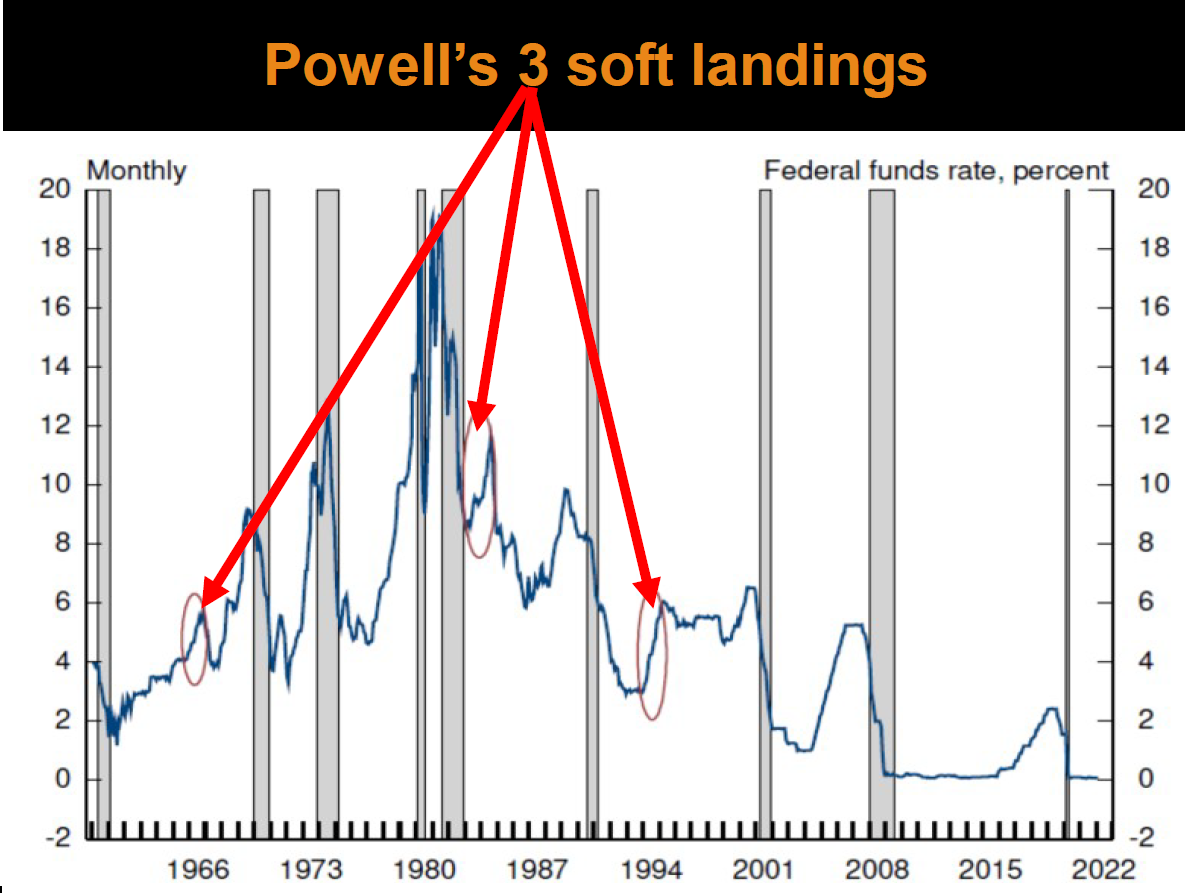

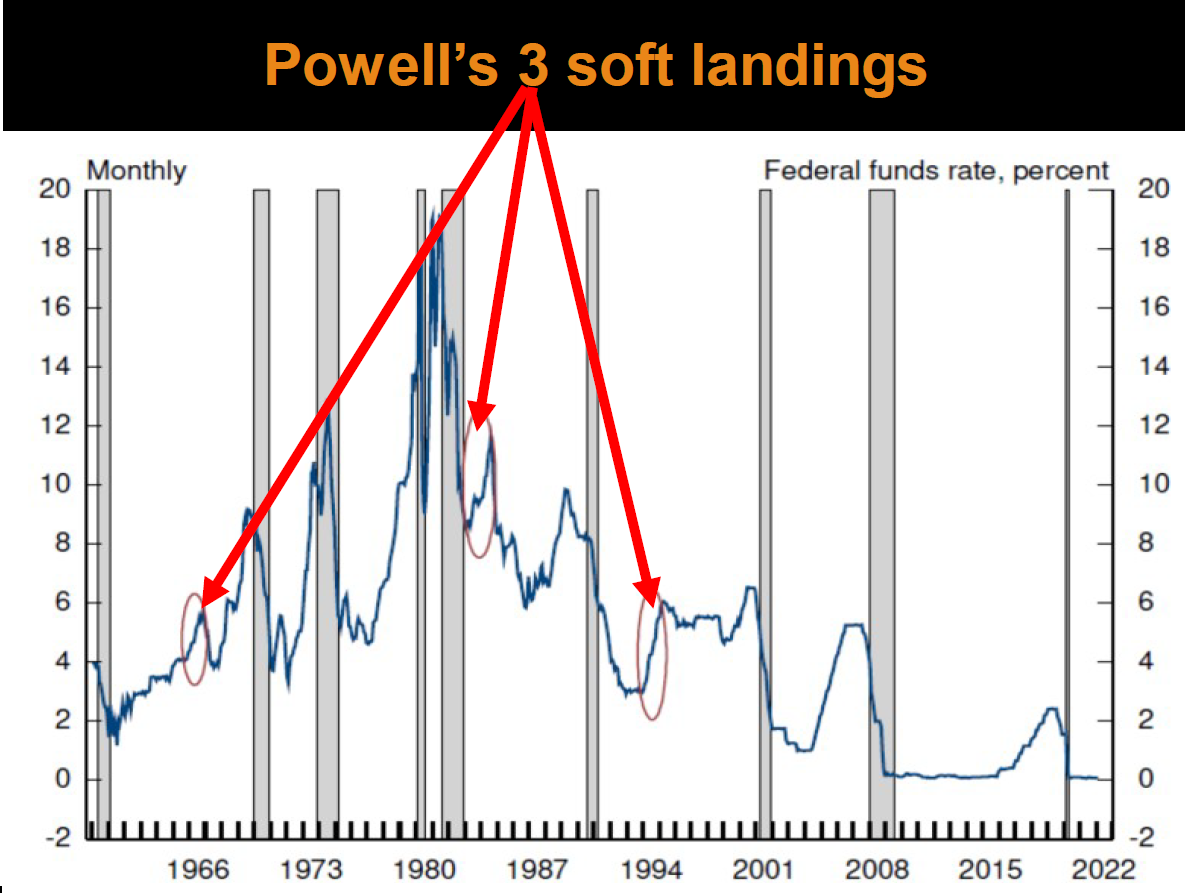

Some individuals, including former members of the FOMC, are not optimistic that a soft landing can be achieved. Chairman Powell acknowledged their skepticism when he stated, “Some have argued that history stacks the odds against achieving a soft landing and point to the 1994 episode as the only successful soft landing in the postwar period…the record provides some ground for optimism: Soft, or at least soft-ish, landings occurred in 1965, 1984, and 1994—the Fed raised the federal funds rate significantly in response to inflation without precipitating a recession.”

The graph below highlights the three soft landings, with the gray bars representing recessionary periods and the blue line depicting the federal funds rate percentage.

Source: Federal Reserve System

History does support the skeptics. As the graph above clearly illustrates, recessions were ushered in by periods of rising interest rates.

DR. ED’S FINAL THOUGHTS

My advice for high-performance financial institutions…

- 1I encourage you to invest a few minutes to read my recent white paper. What you learn could generate big returns for your financial institution. Contact SB Value Partners for a copy.

- 2Do you know how your business clients are managing in this economic environment? Of course, management must decide the right course of action for their financial institution, but you may want to consider generating loan demand by reaching out to credit-worthy clients. A business line of credit may be exactly what they need to help offset inflationary pressures.

Serving community financial institutions for 30 years.

Providing portfolio advisory services to approximately $3.1 Billion of community bank and credit union investment portfolios.

Actively managing over $449 Million for community financial institutions and their customers in managed accounts and 3(C)(1) L.P.’s.

SEC NUMBER 801-66139.

William Barnes | VP – Business Development

John Evans | SVP – Growth Department

![]()

![]()

![]()

![]()