BREAKING NEWS — MARKET SPECULATION & THE STATE OF THE ECONOMY

DATE: February 8, 2023 | BY: Dr. Edmond J. Seifried, PhD | TOPIC: The Big Question…Is a recession on the horizon?

- The February ‘23 Unemployment Rate stands at 3.4% – the lowest unemployment rate since 1969. We chase a Goldilocks economy as unemployment drops, we experience positive job growth, and slow wage growth

- Labor Force Participation is still very low with a rate of 62.4% in January. Sahm’s Rule holds that a recession occurs whenever the three-month moving average of the unemployment rate rises 0.5% over its minimum rate from the previous 12 months. Watch for changes as we progress during 2023.

- The US 12-month CPI fell from 7.1% in November to 6.5% in December and the 12-month PPI fell from 7.4% in November to 6.2% in December.

- By unanimous consent, the Fed Funds Rate was increased by 1/4%, bringing the new target rate to 4.50%-4.75%. In a February 1st press statement, Chairman Powell cautioned against loosening policy prematurely. He was quoted as saying, “We will stay the course until the job is done. But the job is not done yet, core services inflation ex-housing has not come down.”

- GDP rose by 2.9% in Q4, and early forecast from GDP Now predict a Q1 ’23 increase of +2.1%. The Q4 growth was attributed to increases in inventory investments by manufacturers, consumer spending (with increases primarily in healthcare and auto purchases/parts and reductions in food and beverages spending at home – the pantry effect), government spending, and business investment. GDP growth was slowed by decreases in housing investments and exports.

- Total personal savings increased to $0.553 trillion in Q4 compared to $0.5087 trillion in Q3. The personal savings rate (personal savings as a percentage of disposable personal income) was +2.9% in Q4, up from +2.7% in Q3.

- If R* can increase over time…interest rate margins may follow. What is R*? It is the neutral rate of interest, neither stimulating nor restraining the economy when the inflation rate is stable and on target.

RECESSION & THE YIELD CURVE

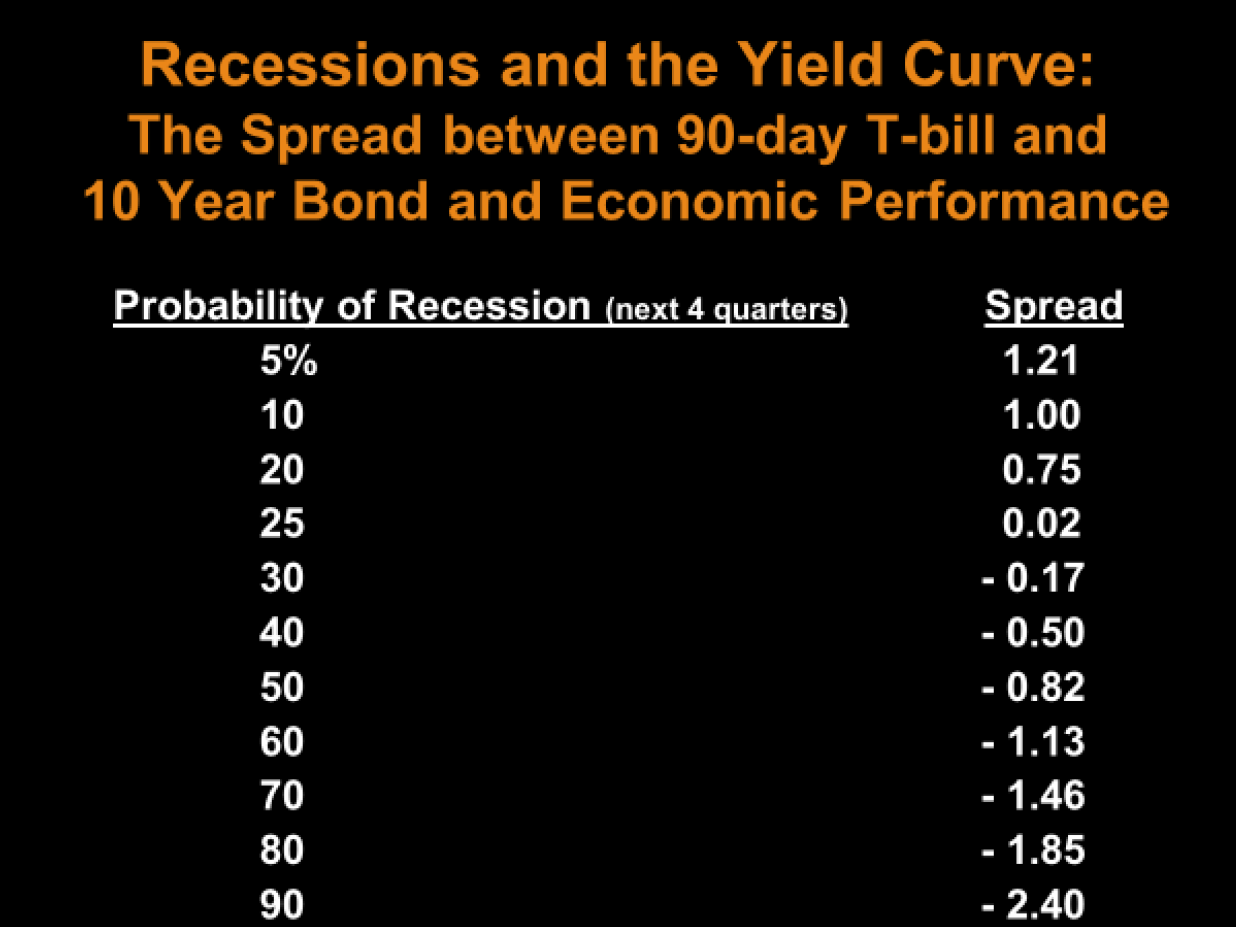

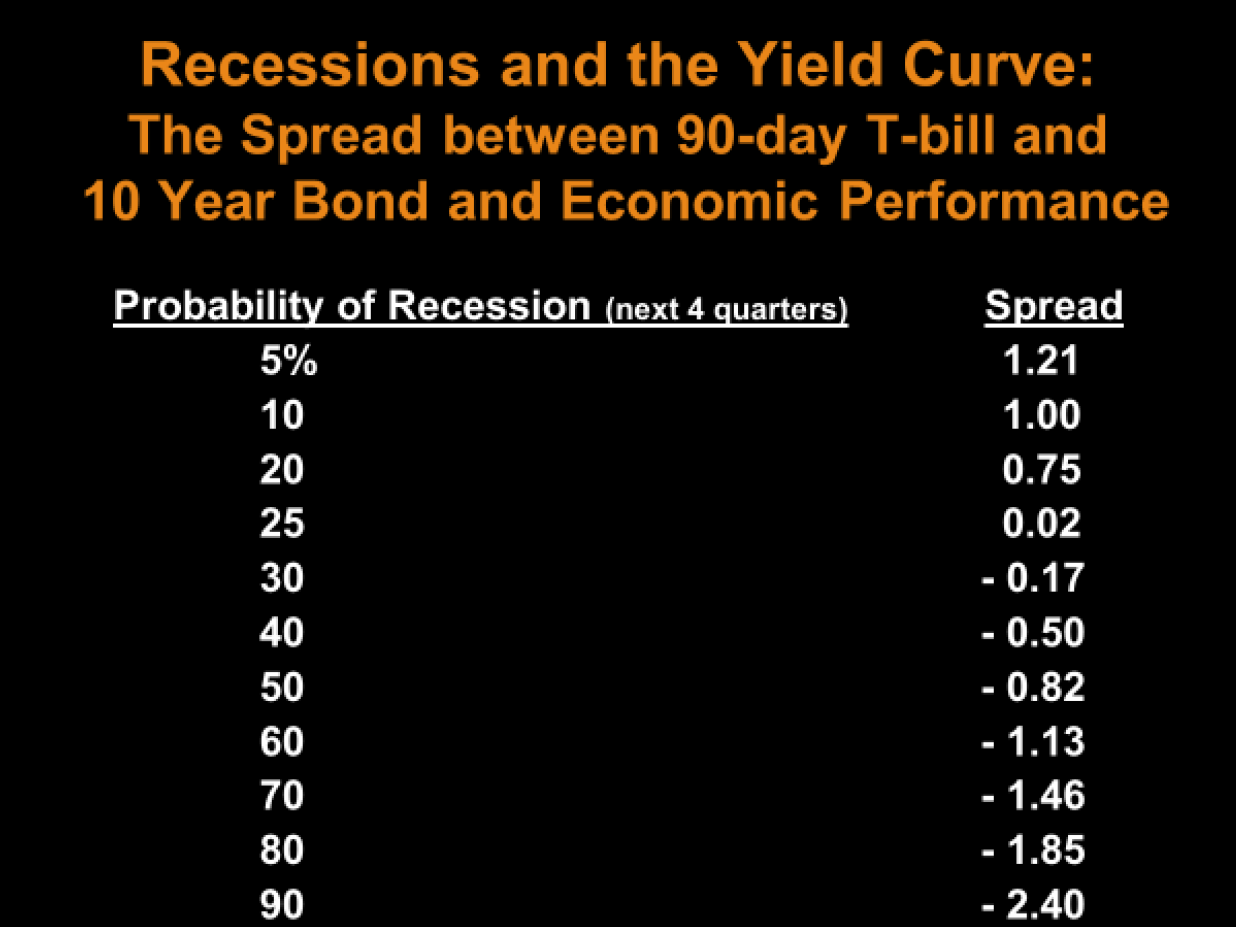

The spread between the 90-day T-bill and the 10-year Treasury bond yield has been shrinking but remained positive from September ’21 through September ’22 with a spread of 1.48% and 0.56%, respectively. However, beginning in Q4 ’22 and continuing into the new year, the spread has flipped negative with a February 6th spread of -1.01%. History has shown a correlation with the spread between the 90-day T-Bill and 10-year Treasury Bond yield, as show in the table below:

Given the current spread, the probability of a recession in the next 4 quarters would fall at approximately 55%. Watch for new updates throughout the year.

SB VALUE BEST PRACTICES

- When generating fixed income portfolio liquidity, make sure to manage earnings (AOCI ramifications) AND correctly model the balance of the portfolio in regard to rate sensitivities, capital structure, etc.

- Regulators in the future will most likely make deeper dives into the pricing, risk and liquidity of individual municipal positions – and your understanding of each. Make sure you use tools that analyze the risk and marketability of individual issues and do NOT rely on stale issuer financial statements.

Contact SB Value Experts for low-cost AI portfolio tools and advice.

”

ABOUT THE AUTHOR

Dr. Edmond J. Seifried, PhD

Dr. Seifried is Professor Emeritus of Economics and Business at Lafayette College in Easton, Pennsylvania and Executive Consultant for the Sheshunoff CEO Affiliation Programs.

Dr. Seifried serves as the dean of the Virginia and West Virginia Banking Schools and has served on the faculty of numerous banking schools including: Stonier Graduate School of Banking, and the Graduate School of Banking of the South.

Serving community financial institutions for 30 years.

Providing portfolio advisory services to approximately $3.8 Billion of community bank and credit union investment portfolios.

Actively managing over $400 Million for community financial institutions and their customers in managed accounts and 3(C)(1) L.P.’s.

SEC NUMBER 801-66139.

John EvansSVP – Growth & Development

William BarnesVP – Business Development

![]()

![]()

![]()

![]()