BREAKING NEWS — MARKET SPECULATION & THE STATE OF THE ECONOMY

DATE: August 2, 2022 | BY: Dr. Edmond J. Seifried, PhD | TOPIC: The Big Question…Are we entering a recessionary period?

- Three factors that typically increase the 10–year Treasury yields include 1) a reduction in the Fed’s Balance Sheet, 2) expectations of rising inflation rates, and 3) a decreased demand for US Treasuries. With the Fed combating rising inflation rates through its planned Balance Sheet reduction, the SAFE HARBOR EFFECT may partially offset the resulting impact on Treasury yields as world–wide investors seek out the stability of US Treasuries during periods of global political upheaval and economic uncertainty…thus increasing demand and lowering the 10–year yield.

- GDP fell by –1.6% and –0.9% in Q1 and Q2, respectively, primarily due to decreased inventory investments. GDPNow forecasts a modest +1.3% for Q3.

- So, with two consecutive quarters of negative GDP, are we in a recession? While historically, back–to– back quarters of negative GDP have ushered in a recessionary period, that alone is not an established rule. The National Bureau of Economic Research, the non–profit organization responsible for setting the start and end dates of recessionary periods, has been quiet on the matter. In contrast, Chairman Powell has shared his belief that we are not entering a recessionary period, citing RESIDUAL SEASONALITY as the basis for his opinion. He implied that GDP may have been artificially lowered due to the complexities of smoothing for seasonal factors thus far in 2022.

- The Economic Puzzle of 2022 — How is the labor market so strong during a weak economic period? In reality, the 3.6% current unemployment rate may not be as strong as the number would indicate. Not only has the labor force participation rate been declining for decades, but a significantly higher number of individuals, who reached retirement age during COVID, left the work force rather than continuing to work…approximately two million more than expected. The unemployment rate would be closer to 10% if adjusted for the higher ‘drop–out’ rate.

- Personal savings decreased to $0.97 trillion in Q2 compared to $1.03 trillion in Q1. The personal savings rate (personal savings as a percentage of disposable personal income) dropped to +5.2% in Q2, relative to +5.6% in Q1.

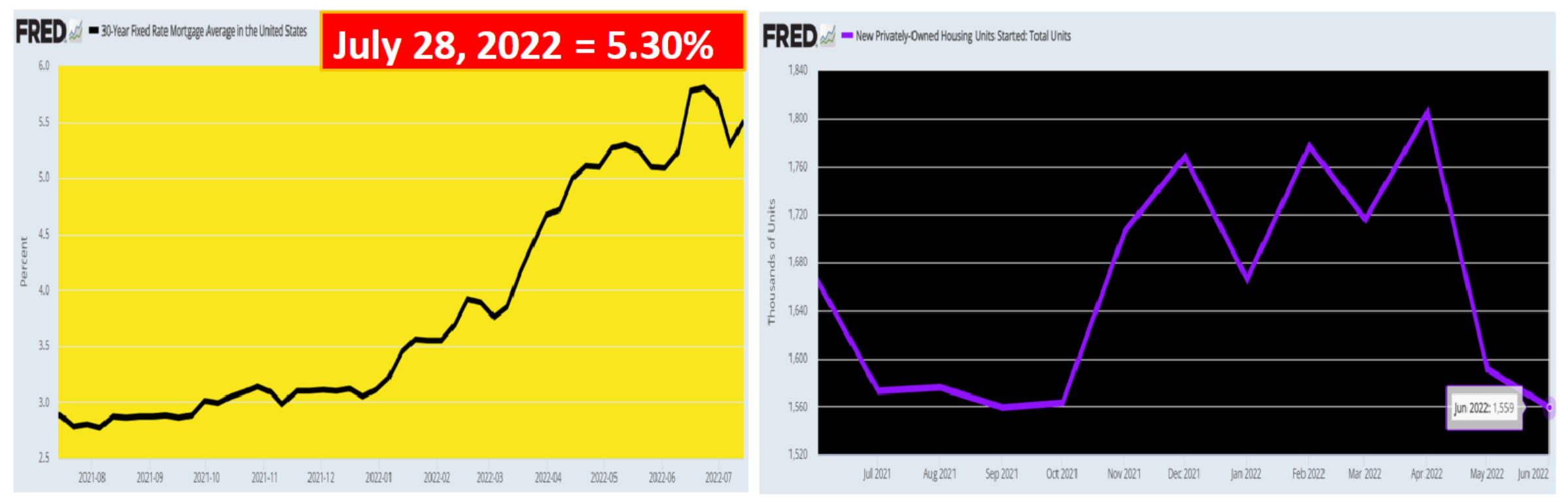

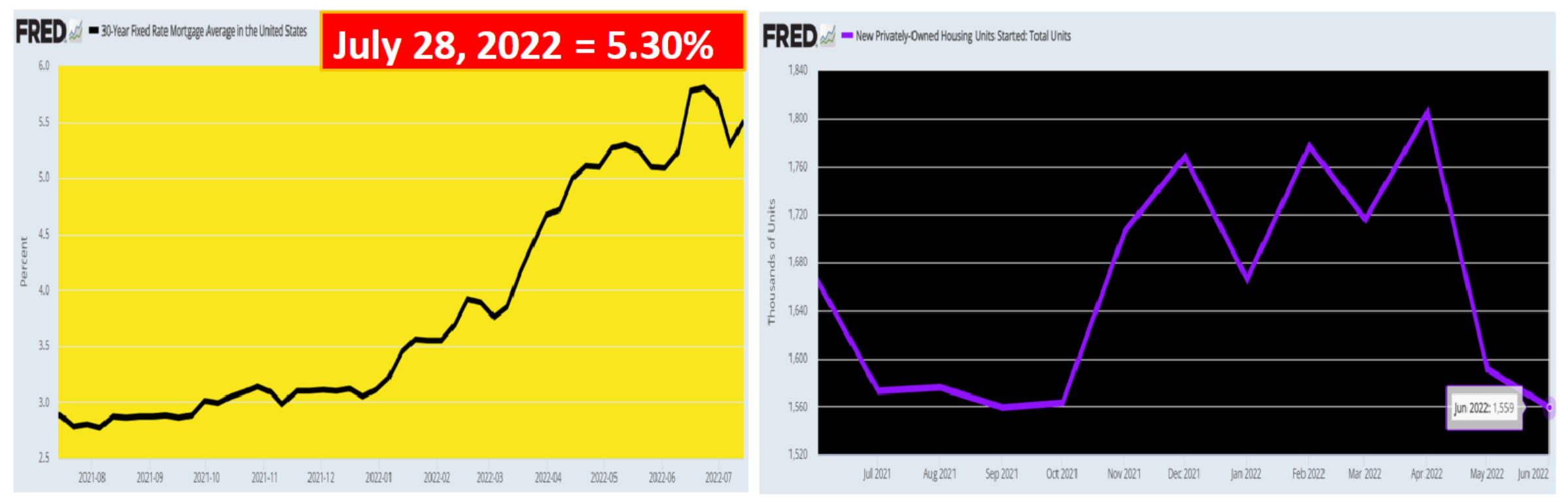

THIRTY YEAR FIXED RATE MORTGAGE RATES & HOUSING STARTS

Another factor to consider regarding a potential recessionary period is the significant drop in housing starts in tandem with the recent rise in mortgage rates. The Yellow graph below depicts the average 30–year fixed rate mortgage rate. The adjacent graph illustrates the drastic drop in housing starts during the relevant time frame.

This is a correlation financial institutions should consider as they prepare for a potential recession.

DR. ED’S FINAL THOUGHTS

So, what should financial institutions consider when preparing for a possible recession…

- 1Review Loan/Deposit Ratios

- 2Tighten Credit Standards

- 3Pay Close Attention to Delinquencies

- 4Contact SB Value Experts for Additional Strategies

”

ABOUT THE AUTHOR

Dr. Edmond J. Seifried, PhD

Dr. Seifried is Professor Emeritus of Economics and Business at Lafayette College in Easton, Pennsylvania and Executive Consultant for the Sheshunoff CEO Affiliation Programs.

Dr. Seifried serves as the dean of the Virginia and West Virginia Banking Schools and has served on the faculty of numerous banking schools including: Stonier Graduate School of Banking, and the Graduate School of Banking of the South.

Serving community financial institutions for 30 years.

Providing portfolio advisory services to approximately $2.3 Billion of community bank and credit union investment portfolios.

Actively managing over $477 Million for community financial institutions and their customers in managed accounts and 3(C)(1) L.P.’s.

SEC NUMBER 801-66139.

John EvansSVP – Growth & Development

William BarnesVP – Business Development

![]()

![]()

![]()

![]()