FEDERAL OPEN MARKET COMMITTEE (FOMC) MEETING RESULTS:

DATE: March 21-22, 2023

- 1The Fed increased its target range by 25 basis points. The new target range is 4.75% – 5.00%.

- 2The FOMC, which began to shrink its securities portfolio on June 1, 2022, announced it will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities, as described in the Plans for Reducing the Size of the Federal Reserve’sBalance Sheet that it announced at the May 2022 FOMC meeting.

- 3The Committee emphasized that the U.S. commercial banking system is safe and sound.

ECONOMIC HIGHLIGHTS: Economic activity continues to grow modestly, and inflation remains too high!

- Recent indicators point to modest growth in spending and production.

- Job gains have picked up in recent months and are running at a robust pace; theunemployment rate has remained low.

- Inflation remains elevated.

- The U.S. banking system is sound and resilient. Recent developments are likely to result in tighter credit conditions for households and businesses and to weigh on economic activity, hiring, andinflation. The extent of these effects is uncretain.

- The Committee is highly attentive to inflation risks.

ANNOUNCEMENTS: Fed funds rate increased. Fed funds range raised by a 0.25% to a newrange of 4.75% to 5.00%, and balance sheet reductions continue.

- The Committee seeks to achieve maximum employment and inflation at the rate of 2% over the longer run. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 4.75% – 5.00%.

- The Committee will closely monitor incoming information and assess the implications for monetary policy. The Committee anticipates that some additional policy firming may be in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2% over time.

- In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.

- In addition, the Committee will continue reducing its holdings of Treasury securities andagency debt and agency mortgage-backed securities, as described in its previously announcedplans.

- The Committee is strongly committed to returning inflation to its 2% objective.

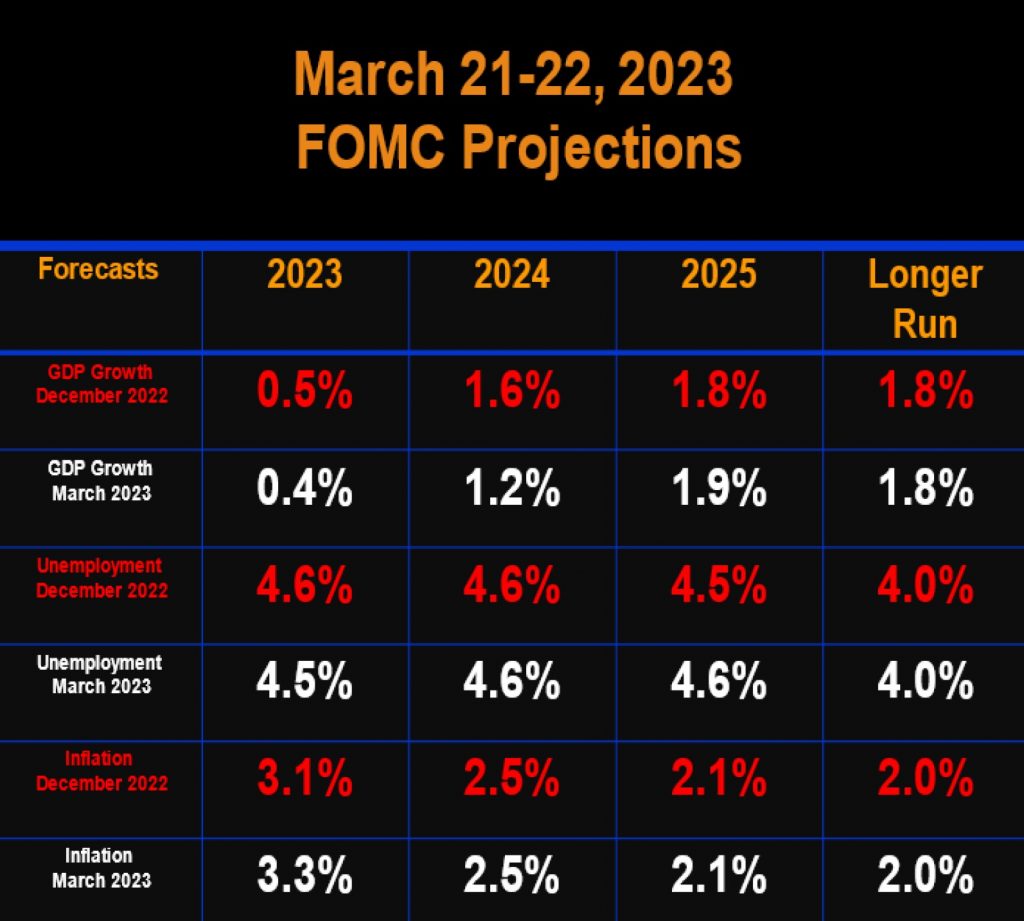

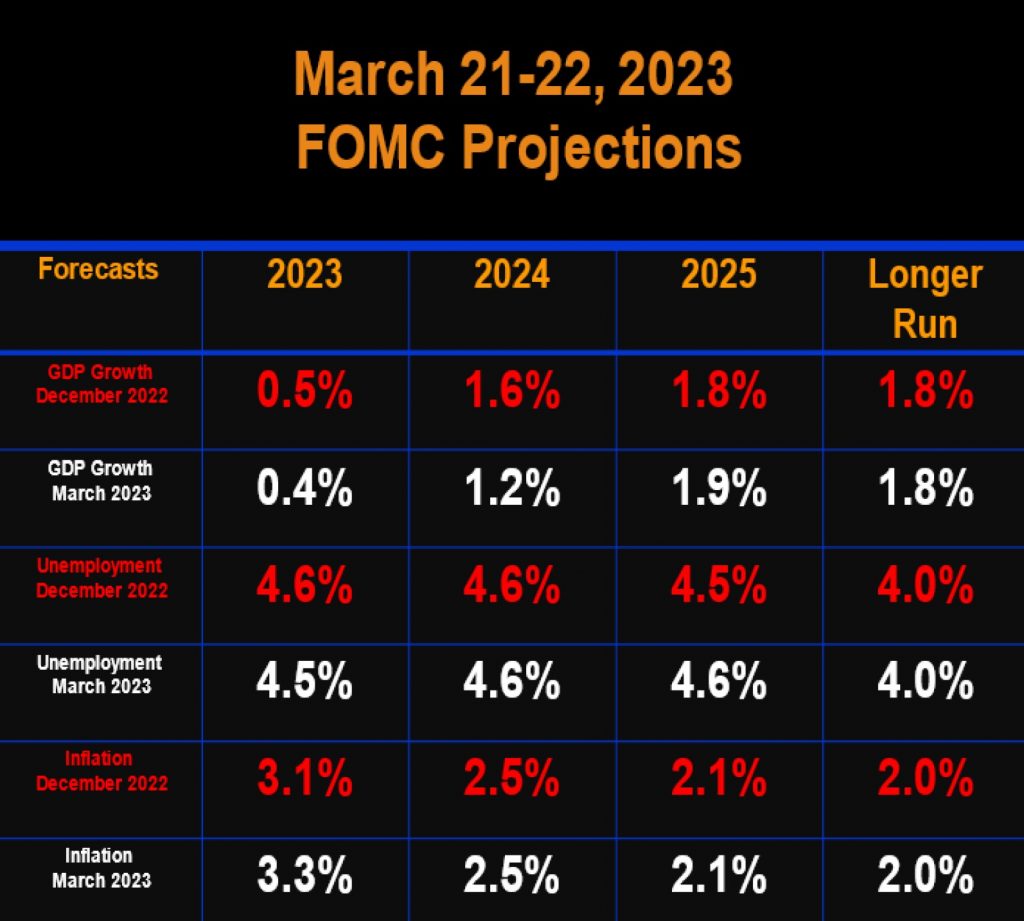

FED’S NEW ECONOMIC PROJECTIONS: The FOMC’s most recent Economic Projections have changed. See the changes in the chart below:

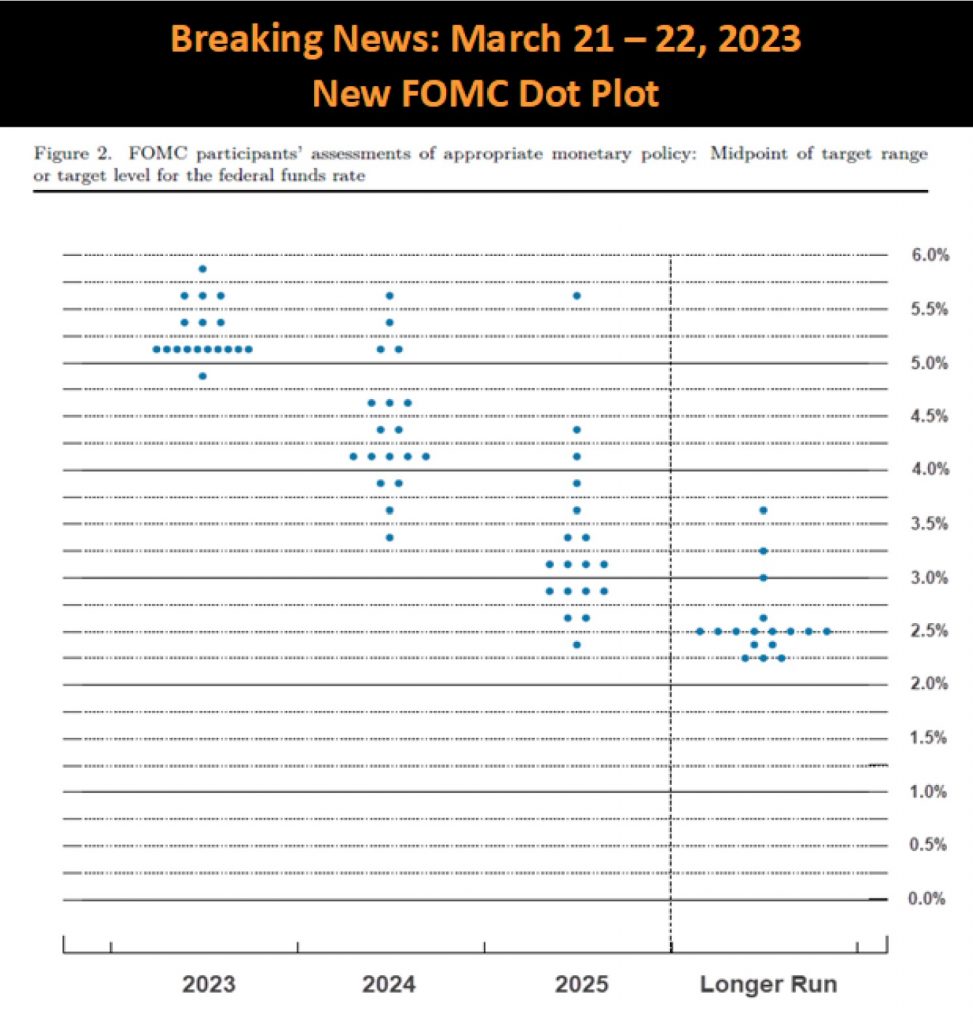

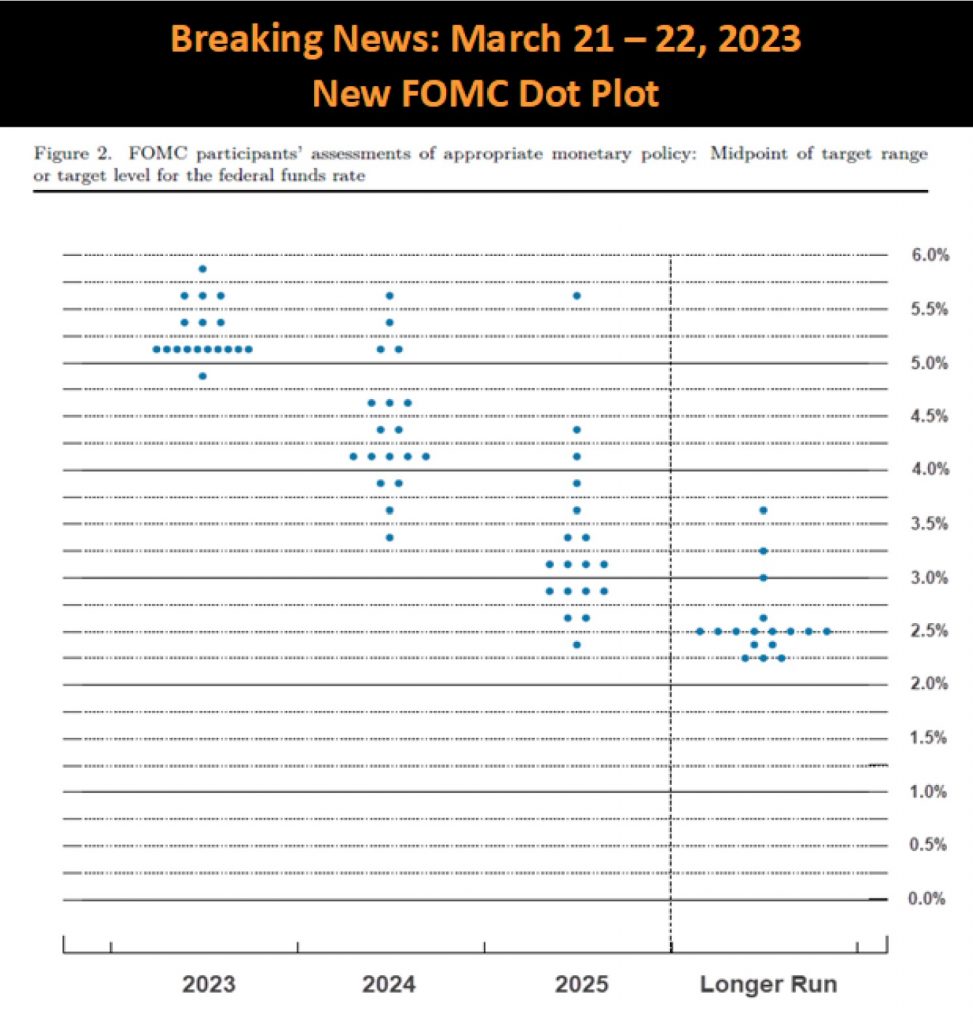

FED’S NEW DOT PLOT: The FOMC’s most recent Economic Projections have changed. See the changes in the chart below:

VOTING RESULTS: No dissenting votes

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michael S. Barr; Michelle W. Bowman; Lisa D. Cook; Austan D. Goolsbee; Patrick Harker; Philip N. Jefferson; Neel Kashkari; Lorie K. Logan; and Christopher J. Waller.

NEXT MEETING: May 2 – 3, 2023

”

ABOUT THE AUTHOR

Dr. Edmond J. Seifried, PhD

Dr. Seifried is Professor Emeritus of Economics and Business at Lafayette College in Easton, Pennsylvania and Executive Consultant for the Sheshunoff CEO Affiliation Programs.

Dr. Seifried serves as the dean of the Virginia and West Virginia Banking Schools and has served on the faculty of numerous banking schools including: Stonier Graduate School of Banking, and the Graduate School of Banking of the South.