There just aren’t enough hours in the day. How often does that thought cross your mind?

Our lives are so busy we schedule our day down to the last minute to ensure we make the most of our time, both professionally and personally. Work calendars are packed with meetings, personal schedules ensure quality time with family and friends, and creative ones, like color-coded calendars, hang on the fridge to tell us who’s taking which kid to which practice and when.

Comprehensive planning for the entire year allows us to not only consider the full scope of what we may want to accomplish but also to spread the work out consistently throughout the year…allowing us to achieve a full slate of best practices. This approach should be taken when planning for the many risk assessments, strategic opportunities, and regulatory requirements facing financial institutions on an annual basis.

Developing an annual ALCO calendar is a best practice that every financial institution should include in their preparatory efforts for each new year, just like the annual budget and audit schedule.

There is a lot more to ALCO than meeting quarterly to assess interest rate risk. Preparing an annual calendar ensures that nothing falls through the cracks and paves the way for a positive regulatory review. After all, it’s frustrating realizing a required task fell through the cracks right before the start of an annual review.

“The key is not to prioritize what’s on your schedule, but to schedule your priorities.”

– Stephen Covey

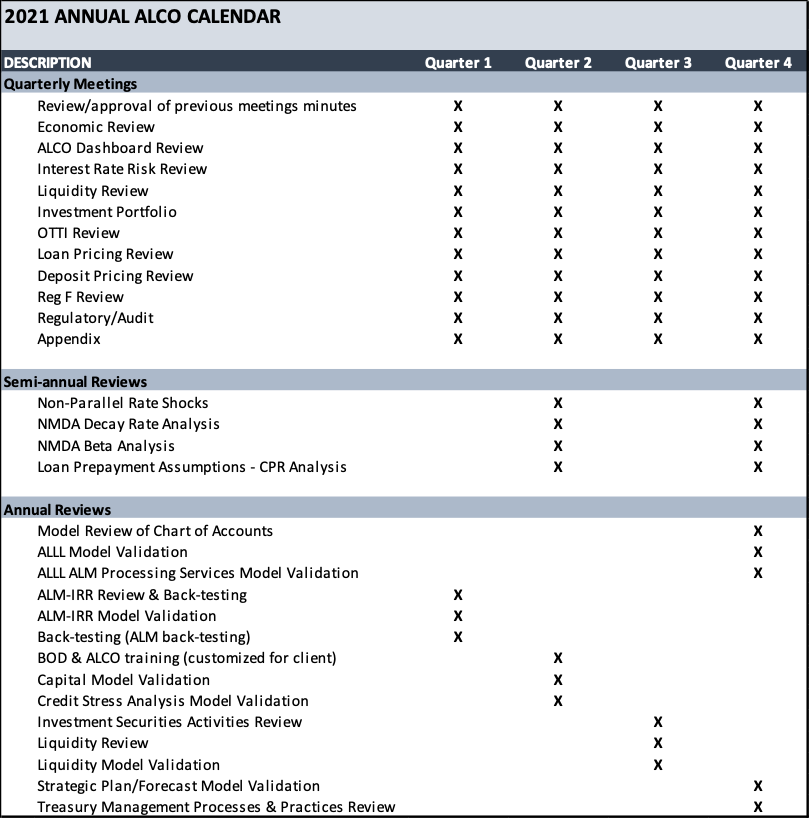

The items listed below represent just some of the events that should be included in an ALCO Annual Calendar:

The aforementioned items should be combined with your standard quarterly ALCO agenda to create and best practices ALCO schedule for the entire year.

To illustrate, we’ve created the matrix below that may be developed into a full year calendar:

“Planning is bringing the future into the present so that you can do something about it now.”

– Alan Lakein (Author on Time Management, Graduate of Johns Hopkins University & Harvard Business School)

Developing an annual calendar is the first step in building a comprehensive ALCO management strategy. If you are not already doing so, we at HBP Analytics and SB Value Partners encourage you to create a comprehensive ALCO calendar for 2021.

ABOUT HBP ANALYTICS

With over 100 years of combined community banking experience and our hands-on approach, HBP offers specialized services in the areas of Asset & Liability Management, ALM Reviews & Model Validation, Liquidity Reviews, Credit Stress Analysis Model Validation, and Assumptions Analysis (decay rates, betas, and loan prepayment). With our shared dedication to the community banking industry, HBP is proud to be a preferred partner on SB Value’s Ancillary Services Platform. Contact Pat Dorn at pdorn@hbpanalytics.com, (702) 300-2891 or Mo Sullivan at msullivan@hbpanalytics.com, (702) 271-7367 for assistance with ALCO management.

ABOUT SB VALUE PARTNERS L.P.

As the industry’s low-cost provider of advisory services and Fintech solutions, SB Value Partners has expanded its client services by partnering with firms specializing in ALCO, Custody & Safekeeping, and Bond Accounting.

Contact Kayla Gaylord at kayla.gaylord@sbvalue.com, (210) 686-2853 to learn about SB Value’s innovative advisory services platform and to see if they may be able to improve the ROA and ROE from your investment portfolio.