Community financial institutions (CFI’s) are arguably more challenged than they have been in decades. So, happily, many CFI’s drew a big, red circle around their 2023 calendars when several of those deadlines were postponed. Specifically, those deadlines include to the deferral of the CFI’s Current Expected Credit Loss (CECL) implementation date until January 2023 and the cessation of the most commonly referenced USD LIBOR publications until June 2023.

“You may delay, but time will not, and lost time is never found again.”

– Benjamin Franklin

While management may be grateful for the additional time, be assured, preparatory work is extensive and cannot be postponed if deadlines are to be successfully met. Take advantage of this opportunity to ensure that your CFI is fully prepared.

The deferral of the CECL Implementation for certain entities, including CFI’s, was announced in November 2019, by the Financial Accounting Standards Board (FASB). For most, this was a welcomed reprieve, but this should be a call to action, not permission to postpone progress.

If you find that your CFI is ill-prepared for the 2021 and 2022 implementation benchmarks, you are not alone. What’s the good news…?

AMG has developed an implementation glidepath and the technology for a fully functional CECL Calculator, which is easy to use, comprehensive and affordable.

As you move forward with your CECL implementation, keep in mind the following points:

Why the Sense of Urgency?

CECL Touches Numerous Departments: Accounting, Compliance, IT, Treasury, BOD’s Education, etc.

The Challenges of Data Management:

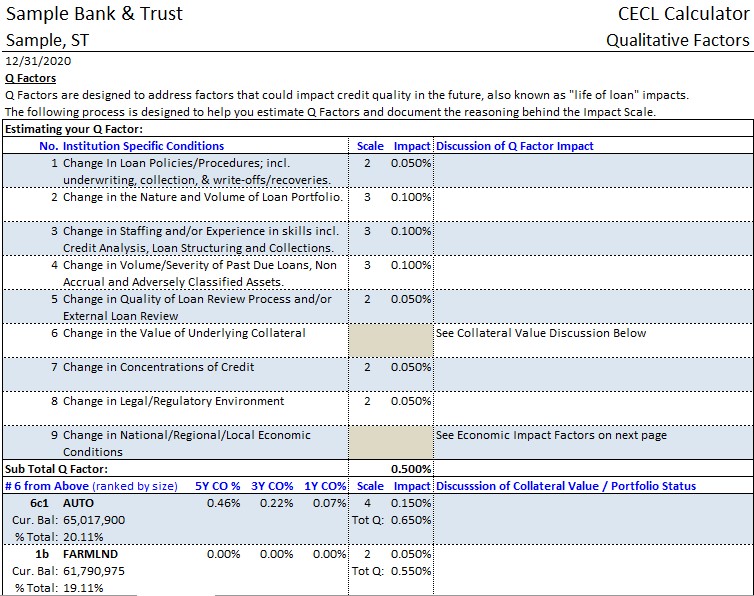

Qualitative Factors (Q Factors):

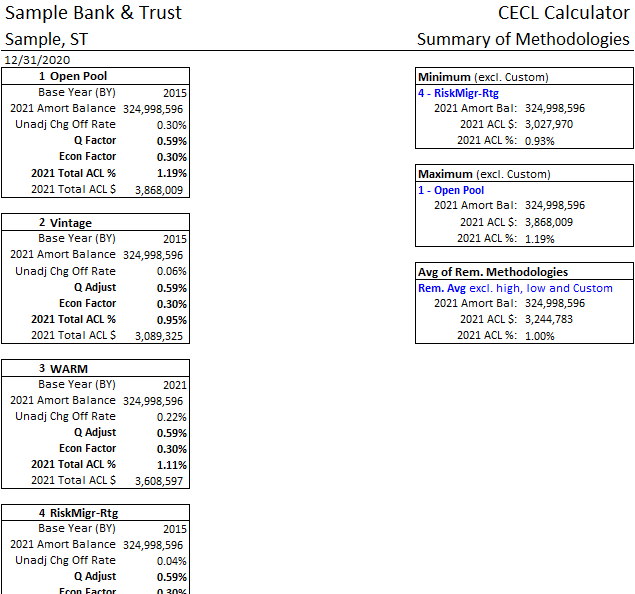

Multiple Calculation Methodologies:

Multiple calculation models must be developed and calculated simultaneously for comparison and validation purposes. See AMG’s example below:

Below are some of the key features and functionality of AMG’s CECL calculator:

Currently, if your CFI is not required to calculate a reserve for its investment portfolio, the implementation of CECL is unlikely to change the existing process (unless the composition of the investment portfolio changes). The major factors to consider when implementing CECL are the classifications of your investment securities and any credit impairments of individual securities. Available for sale (AFS) securities are marked to market and will not be impacted by the CECL implementation. Held to Maturity (HTM) securities, on the other hand, will require changes if your portfolio includes credit impaired securities. AMG is available to discuss the specific reserve calculation changes applicable to your CFI.

Of course, the topics discussed above do not represent a comprehensive list of implementation items. Numerous additional processes and functionality will need to be addressed, such as quantifying macroeconomic correlations. AMG has the expertise, resources, and systems in place to propel your implementation process forward…at a reasonable rate and without burdening an overly taxed internal staff.

A comprehensive implementation plan should be in progress now.

For a live demonstration of the BancPath® CECL Calculator contact us today! sdoherty@countryclubbank.com

ABOUT SB VALUE PARTNERS L.P. & AMG

As the industry’s low-cost provider of Advisory Services and Fintech solutions, SB Value Partners has expanded its client services by partnering with firms specializing in ALCO, Custody & Safekeeping, and Portfolio Accounting.

We, at AMG, are proud of our association with SB Value Partners and look forward to the opportunity to assist their financial institution partners with their Asset & Liability Management. For more details of how AMG may be of service, please contact Sean Doherty at sdoherty@countryclubbank.com, (816) 751-9321.

To learn about SB Value Partner’s innovative advisory services platform, contact Kayla Gaylord at kayla.gaylord@sbvalue.com, (210) 686-2853. See if they may be able to improve the ROA and ROE of your investment portfolio.

”

ABOUT THE AUTHOR

Sean Doherty – President, AMG

As President of Asset Management Group, Inc. (AMG), a wholly owned subsidiary of Country Club Bank, Sean is actively involved in the day-to-day management of the firm, and the development of strategies and products to assist community financial institutions in managing their investment portfolios, as well as Total Balance Sheet Management achieved through the BancPath® suite of risk management products. Sean is involved in the ongoing development of systems to reflect changing regulatory environment.

Sean graduated from Benedictine College in 1982 with a B.A in economics and a B.A. in business administration. He received his M.B.A. from Rockhurst College in 1985.

In his free time, Sean enjoys spending time with his wife, Julie, their four children, and two grandchildren. He is also a member of the Board of Trustees at Benedictine College in Atchison, KS.