Decision making is an essential skill of every successful business leader. While easier said than done, decision makers must interpret a wealth of relevant data, account for an ever-changing environment, and chart a course in the midst of relentless competition.

“Wherever you see a successful business, someone once made a courageous decision.”

– Peter Drucker

For leaders in community financial institutions, ALCO reports provide a wealth of relevant financial information and a comprehensive balance sheet perspective for decision making. When used correctly, ALCO reporting should be the “go to” data for strategic decision making (and your ALCO consultant should be on speed dial).

But even with ample financial data available, we rarely make business decisions based strictly on facts and financial information alone. Many successful business leaders make “gut decisions” that are supported by the facts. Consider the following:

“I rely far more on gut instinct than researching huge amounts of statistics.”

– Richard Branson

“Follow your instincts. That’s where true wisdom manifests itself.”

– Oprah Winfrey

With so many of our decisions being influenced by this “gut feeling,” how do we, as business leaders, know that we can trust this feeling? Where does this feeling even come from?

In his book Emotional Intelligence, Daniel Goleman explains that there is a part of your brain in the Basal Ganglia that summarizes your emotional response during decision making. The problem is that language does not exist in that specific area of the brain. Nor does that part of your brain communicate with any other location where language does exist. It only connects to your GI track and your limbic system. So, it sends emotional feedback through felt sensations…a “gut feeling.”

So, now that we know the source of our gut feelings, can they always be trusted?

Well…sometimes our personal biases cunningly disguise themselves as a “gut feeling” or “intuition.” If you are caught off guard and rely on a personal bias, you may make a poor business decision and limit the long-term performance of your financial institution.

So, how do you tell the difference between a “gut feeling” and a personal bias?

Educate yourself. Be aware of the common types of personal biases and base your decisions on solid reasoning and hard facts, such as those found in ALCO reports.

But every good leader already does that, right?

Every good leader is human, and, by nature, we all have inherent personal biases that impact our decision making. The key is to be self-aware.

The following are some of the most common types of personal biases:

Recency Bias is the belief that what is most recent will continue “for the time being.” This is easily demonstrated with interest rates. When rates are increasing or high, and loan demand is generally good, we tend to believe that rates will likely go higher still, and that we must lock in long term deposits to fund this ever-increasing loan demand. So, we extend funding (both at the wholesale and retail levels) in an effort to lock in today’s rates before they go even higher. Similarly, when rates are declining or low, loan demand is generally weaker and short-term deposits are generally “cheap.” Consequently, we tend to stay short with funding, because the higher costing, longer term funding is considered relatively expensive. And low rates will likely be around for the foreseeable future (sound familiar?).

With rates at record lows and the Federal Reserve Board’s Dot Plot indicating a consistent rate for the foreseeable future, Recency Bias would influence our decision making and strategic development based on the current rate environment. So, when reviewing ALCO reports, the board of directors and key executives may be fully aware of the financial impact of increasing interest rates. However, because of the inherent bias, they may not seriously consider a strategic plan for rising interest rates, leaving their financial institution ill prepared for such an occurrence.

Some might say this is a bad example. After all, you might personally believe that interest rates will stay steady for the foreseeable future. No changes, right? The Fed thinks so. Most economists concur.

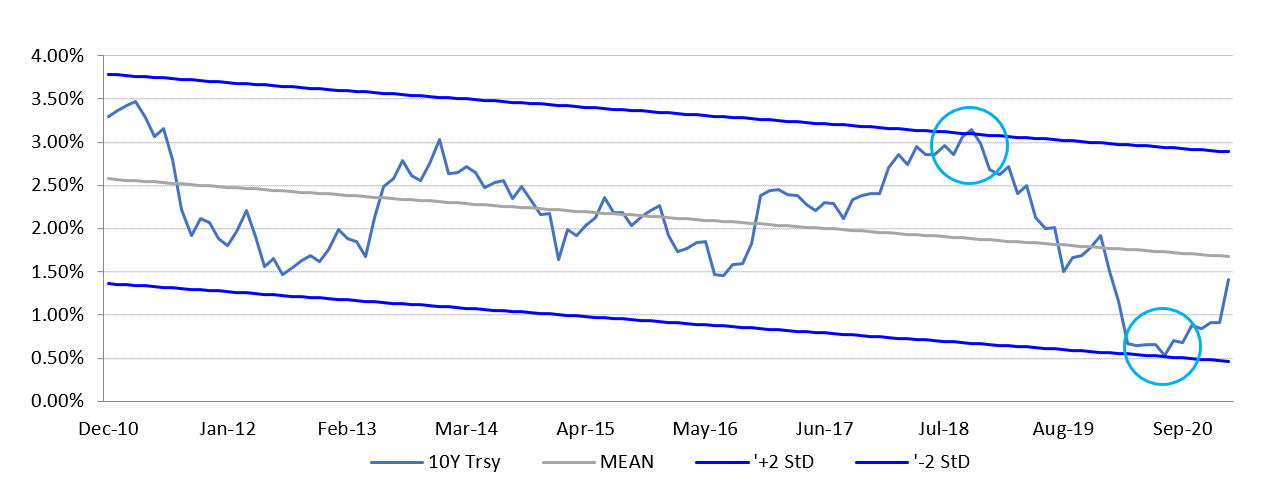

Well, let’s look at the historical fluctuations in interest rates. The graph below represents a statistical regression on the 10-year treasury yield. The Blue lines represent +/- 2 Standard Deviations (StD) from the mean.

History shows us that there is typically a reversion to the mean as rates fluctuate. If rates drop by 1 StD, there is a 64% chance they will increase, at +2StD, that probability increases to 95%. Consider the rise in the 2018 interest rates compared to the drop in 2020. Looking back, would we have changed our decisions given this information?

While data like that presented above cannot tell us when rate changes will happen, it does help us see the probabilities of those changes occurring. I also believe that many decisions made over the course of the past ten years were based on the assumption that “recent events” would continue. How many of those decisions were made from a recency bias perspective…to the detriment of the financial institution?

Confirmation Bias is the natural tendency of people to favor information that confirms a preexisting belief or hypothesis. In fact, we don’t just favor this confirming information, we actually seek it out to the exclusion of any contradictory information.

You know the perpetual market bears that always see a crash around the corner (and yes, every office has at least one)? They go seeking data that supports their expectations. They are much more likely to accept and recall that data than any information to the contrary. We are all guilty of this to some degree or another. But this can be dangerous, especially in today’s world where there is an unlimited supply of readily available information and varied opinions. This fear of the next crash, I believe leads financial institutions to prefer shorter duration loans and investments, even if that strategy can be shown to cost them both in income and net interest margin.

The world of financial institutions and the markets in which they operate are dynamic and ever changing. Thus, leadership needs to be able to reform opinions and adjust strategic plans based on accurate information in an ever-changing environment.

A Misunderstandings of Statistics is a topic all by itself, but here are a few relevant examples:

Regressive Bias may be one of the most important biases to be aware of when managing a financial institution. It refers to the fact that we grossly overestimate events that have a high likelihood of occurring, and in contrast, underestimate events with a low likelihood. If we hear “there is a 97% chance that loans will pay as agreed,” our brains think of it as a certainty. (when in reality, if only 97% of loans pay as agreed, we would almost certainly have lots of questions to answer). The flip side is essentially the “black swan” issue. Rare and unexpected events are more likely to happen than our brains allow us to believe. This can be catastrophic to your financial institution if you are caught unprepared. Do not ignore potential risks just because they rarely occur. Be prepared.

Sunk Costs are those costs that have already been incurred and cannot be recovered. Unfortunately, sunk costs are often a major factor in decision making and strategic development, especially when significant dollars have been invested. Instead of disregarding sunk costs, many organizations fall victim to a false mindset. Such as:

“We spent X dollars on the software, so we are sticking with it even though it is clearly not the best solution.”

or

“We just started cutting deposit rates last month, so we can’t increase them this month.”

Financial institutions should always be evaluating where they are currently, regularly conferring with their ALCO consultant, and making optimal decisions for the future.

Personal biases can readily influence decision making, frequently under the guise of gut instincts. Be self-aware of the common types of biases so that decisions are made in the best interest of your financial institution.

Your Asset Liability systems can (and SHOULD) provide you with much of the vital information your financial institution needs. The ALM process is often the only function that provides your financial institution with a comprehensive balance sheet perspective. Do not limit your organization by reducing your ALCO process to a regulatory “check the box” exercise. Your ALM system should be the “go to” system for decision making and strategic development. If your current ALCO consulting service is not providing you with the insight and guidance to financially strengthen your financial institution, you need to give AMG a call.

ABOUT SB VALUE PARTNERS L.P. & AMG

As the industry’s low-cost provider of Advisory Services and Fintech solutions, SB Value Partners has expanded its client services by partnering with firms specializing in ALCO, Custody & Safekeeping, and Portfolio Accounting.

We, at AMG, are proud of our association with SB Value Partners and look forward to the opportunity to assist their financial institution partners with their Asset & Liability Management. For more details of how AMG may be of service, please contact Sean Doherty at sdoherty@countryclubbank.com, (816) 751-9321.

To learn about SB Value Partner’s innovative advisory services platform, contact Kayla Gaylord at kayla.gaylord@sbvalue.com, (210) 686-2853. See if they may be able to improve the ROA and ROE of your investment portfolio.

”

ABOUT THE AUTHOR

Sean Doherty – President, AMG

As President of Asset Management Group, Inc. (AMG), a wholly owned subsidiary of Country Club Bank, Sean is actively involved in the day-to-day management of the firm, and the development of strategies and products to assist community financial institutions in managing their investment portfolios, as well as Total Balance Sheet Management achieved through the BancPath® suite of risk management products. Sean is involved in the ongoing development of systems to reflect changing regulatory environment.

Sean graduated from Benedictine College in 1982 with a B.A in economics and a B.A. in business administration. He received his M.B.A. from Rockhurst College in 1985.

In his free time, Sean enjoys spending time with his wife, Julie, their four children, and two grandchildren. He is also a member of the Board of Trustees at Benedictine College in Atchison, KS.